Boeing (BA) kicked off the Dubai Airshow with big news on Monday…

In short, Emirates and flydubai ordered 125 jets from the aircraft maker. The deal is valued at more than $50 billion.

As you might imagine, the deal made headlines around the world. And from there, the news got better for Boeing…

You see, a few years ago, China halted orders of Boeing’s 737 MAX jets. The world power’s decision came after two of the company’s bestselling planes crashed in 2018 and 2019.

According to Boeing, roughly 90% of the 737 MAX jets already in China are now operating again. And yet, the country still hasn’t lifted its ban on new orders.

That might change in the coming days…

Bloomberg reported over the weekend that China could end its freeze as soon as this week. Chinese President Xi Jinping is apparently considering the move as part of his meeting with U.S. President Joe Biden at the Asia-Pacific Economic Cooperation Summit in San Francisco.

So this week’s news is twice as exciting for Boeing. And not surprisingly, the company’s stock popped higher after the two stories broke Monday. It jumped roughly 4% on the day.

Now, many investors are wondering…

Should I buy Boeing now?

We’ll tackle this question together today. As you’ll see, the Power Gauge isn’t convinced…

Folks, Boeing moved higher on Monday after back-to-back bits of good news. But even after that bounce higher, the stock is still down more than 50% from its March 2019 high.

And for good reason…

Airline-industry experts widely agree that Boeing has oversold itself.

Put simply, the company was already struggling to deliver on its existing orders. Now, it has added another 125 jets to its backlog. And if China reopens for business, it could add more.

It’s great to have business. But it’s not great if that business leads to years of bad publicity about delays and glitches. That’s what has happened with Boeing recently.

With that said, I don’t pretend to be an airline-industry expert. But I do know what the Power Gauge says. And unfortunately for Boeing, the answer is clear right now…

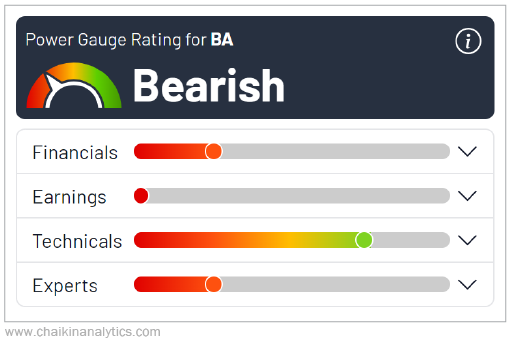

A quick glance at the Power Gauge tells us all we need to know. Boeing earns a “bearish” overall grade right now. Three of the four categories are rated as “bearish” or worse.

The Technicals category is the lone bright spot. It’s “bullish” today. And frankly, it’s what you’d expect in this situation…

The stock produced a positive bump in volume and price trend rate of change. And the Power Gauge is reacting to these developments with a “bullish” grade for the category.

But for Boeing, just about everything else looks rough today…

The company is still broadly underperforming the S&P 500 Index. And according to our system, the aerospace and defense industry’s strength is currently “neutral.”

The Power Gauge helps me see two other warning signs on Boeing’s chart…

First, the stock flashed a “relative strength breakdown” signal in early September. That was right before it started underperforming the broad market. It’s down around 5% since then.

Second, just last week, the company triggered an “overbought sell” warning. That means it’s likely to pull back from its current price in the days and weeks ahead.

In the end, our answer is clear…

The Power Gauge is still “bearish” on Boeing despite this week’s rally.

So I’ll hold off and look for other opportunities. And you should consider doing the same.

Good investing,

Vic Lederman