Apple’s (AAPL) new “Vision Pro” headset is officially available for preorder…

This is the tech giant’s newest sci-fi product. Here’s how Apple described it in a press release last year…

Vision Pro creates an infinite canvas for apps that scales beyond the boundaries of a traditional display and introduces a fully three-dimensional user interface controlled by the most natural and intuitive inputs possible – a user’s eyes, hands, and voice…

The breakthrough design of Vision Pro features an ultra-high-resolution display system that packs 23 million pixels across two displays, and custom Apple silicon in a unique dual-chip design to ensure every experience feels like it’s taking place in front of the user’s eyes in real time.

And here’s what it looks like…

Sounds exciting, right?

But as tech enthusiasts already know, the rollout faces a bumpy start.

The first hurdle is the steep price tag. It costs a whopping $3,500.

That price doesn’t include the case… an extra $200.

And if you wear glasses… be prepared to shell out up to another $150 for custom lenses for it.

Put simply, this is no iPod portable media player. It’s not a mass-market device.

Instead, the Vision Pro is a high-end toy on the leading edge of consumer tech. But that’s creating other problems for Apple…

Multiple companies have already made it clear that they want nothing to do with it. In fact, the headset won’t even have a Netflix app. And it won’t have a native YouTube app, either.

That might sound like it’s driven by tech-company rivalry. But it’s really about the numbers.

Today, let’s take a closer look at those numbers. As I’ll explain, the Vison Pro is a drop in Apple’s revenue bucket…

Folks, there’s a lot of media buzz about this new headset right now. But the numbers tell a different story.

The full launch is tomorrow, and Apple has reportedly sold around 200,000 headsets already. That might sound like a lot. But in the context of Apple’s other products, it’s tiny.

You see, at the lowest cart value, that translates into roughly $700 million. But let’s be generous and round that up to $1 billion, since many buyers are likely purchasing the extra accessories.

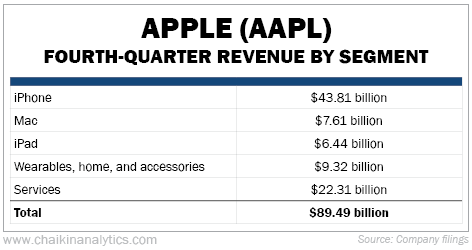

Once again, that number sounds big at first. But remember that we’re talking about the world’s most valuable consumer electronics company here. Take a look at the numbers from Apple’s most recent quarterly revenue report…

Even if we generously round up the Vision Pro figure to $1 billion, it’s simply a drop in the nearly $89.5 billion quarterly revenue bucket. If Apple included it in this recent report, it would account for about 1% of the revenue breakdown.

Obviously, the company is just getting started with the Vision Pro. And a potential $1 billion in preorders is no joke.

But in the context of Apple, it’s still small stuff. The market sees that too…

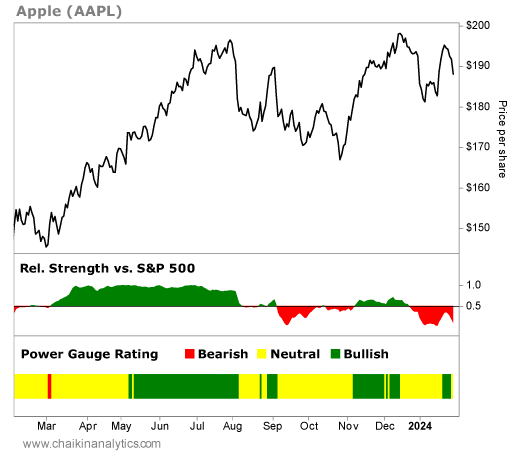

Looking at the Power Gauge, Apple earns a “neutral” rating. That means our system sees Apple as a strong company that’s struggling to trade above its long-term trend.

We can also see in the Power Gauge that Apple has struggled to outperform the S&P 500 Index since early August. (In the chart below, that’s the panel right below the price line section.)

That makes sense, considering Apple’s stock has mostly traded sideways since about that same time. Take a look…

Coming back to the Vision Pro headset, it is an exciting piece of consumer tech. But it’s very expensive. And it’s not a mass-market smash hit… at least not yet.

And considering Apple’s “neutral” rating in the Power Gauge, we’ll have to wait and see if this new device will be enough to help move the needle for the company into stronger territory.

Good investing,

Vic Lederman