Gold prices have been breaking through new highs this year…

Gold is up about 12% since the start of 2024. That has outpaced the tech-heavy Nasdaq Composite Index’s roughly 8% year-to-date rally.

Sure, gold’s big rally this year is impressive. But it’s particularly remarkable because gold is rising in the face of a strong U.S. dollar.

You see, gold and the dollar have traditionally been opposites. People tend to flock to gold during times of high inflation or, as was the case in 2020, record low interest rates.

Low yields on the U.S. dollar increase the appeal of gold, which yields nothing.

As interest rates climb, the appeal of holding gold wanes while that of owning the dollar increases. In this case, the U.S. dollar strengthens.

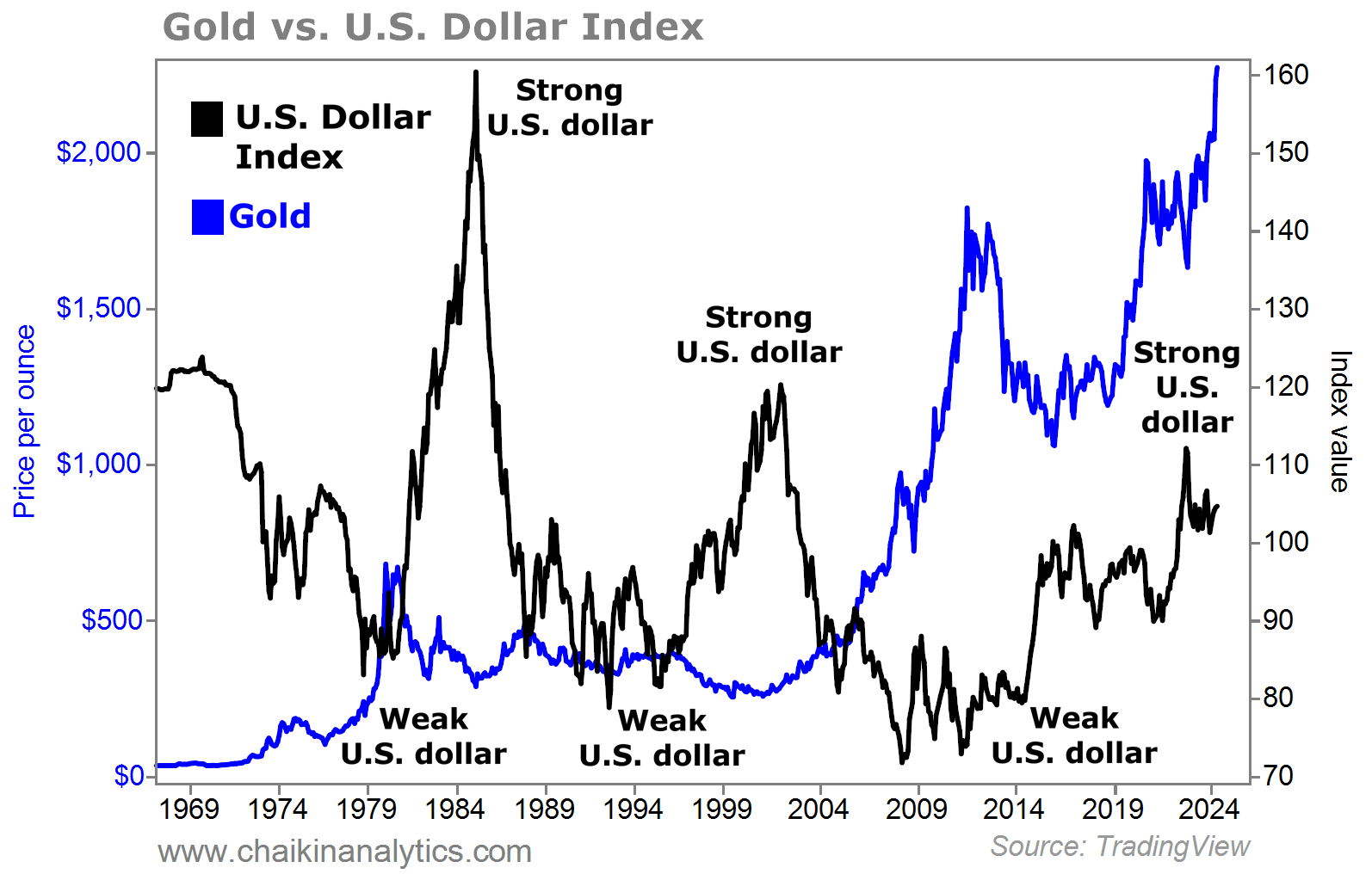

So historically, gold has been weak when the U.S. dollar was strong. You can see what I mean in the chart below comparing the price of gold with the U.S. Dollar Index (“DXY”)…

But something is happening in 2024. The dollar has stayed relatively strong against a basket of currencies. This is largely due to the fact that interest rates are still at the highest they’ve been since March 2001.

At the same time, gold is at a record high of more than $2,300 per ounce.

How can the U.S. dollar and gold both be strong? As I’ll explain next, a big reason is China…

Remember that China is the world’s second-largest economy. Its middle-class population is greater than the size of the entire U.S. population.

More importantly, the Chinese are already the world’s largest consumers of gold. They bought 825 tonnes of it in 2022 and 1,090 tonnes in 2023.

On the other hand, the U.S. consumes just about a quarter of that amount.

And this year, the Chinese are likely to significantly buy a lot more gold.

That’s because the People’s Bank of China (“PBOC”), the country’s central bank, is expected to soon start buying its own treasury bonds like the way the Federal Reserve unleashed quantitative easing (“QE”) after the global financial crisis.

It will be the first time in nearly two decades that the PBOC intervened in the treasury market.

Folks, keep in mind that China’s benchmark interest rate (called its one-year loan prime rate) has been on a gradual decline for the past 10 years…

But this hasn’t been able to give the country’s economy the boost it needs to completely recover from a historic property slump and slowing domestic consumption.

The Chinese government is getting more desperate to ensure that it reaches its economic growth goals. That includes providing jobs for an estimated 10 million new graduates each year.

It has set a target of growing GDP by around 5% this year. But judging by the way its property market remains stuck in reverse, it’s unlikely China will hit that without the kind of QE that helped the U.S. economy get back on its feet 15 years ago.

Buying its own treasury securities to drive interest rates down isn’t guaranteed to help the Chinese government reach its economic targets. But lower interest rates will make gold very attractive for millions of people in the country.

They simply don’t care how strong the U.S. dollar is because ordinary Chinese people can’t easily buy foreign currencies. But they can buy gold.

This helps explain why gold continues to climb in the face of a strong U.S. dollar. And given the state of the Chinese economy today, this will likely help gold keep moving higher.

Good investing,

Vic Lederman