Folks, last week was rough for stocks…

All 11 top-level market sectors fell over the five-day stretch. And the same thing was true for nearly all the main subsectors we follow in the Power Gauge.

The only subsector on our list to not fall was insurance. And that isn’t saying much because the SPDR S&P Insurance Fund (KIE) eked out a measly 0.02% gain for the week.

Not surprisingly, investors pulled a ton of money out of the market as stocks fell. Data from Bank of America (BAC) shows that stocks saw nearly $19 billion in outflows last week.

We haven’t seen a run for the exits like that since last December. And once again, folks are pointing the finger at the Federal Reserve…

Sure, the Fed “paused” its rate-hiking cycle last week. But as many readers know, the central bank doesn’t always act when or how it should…

At its most basic level, the Fed has likely already hiked rates too high. And as investors, we’re in danger of suffering the consequences.

We’re already seeing some of the backlash…

The yield on the 10-year U.S. Treasury note rose to around 4.5% in recent days. It hasn’t eclipsed that level since 2007 – not long before the 2008 financial crisis.

In other words, rates are getting to the point where they’ve historically stalled the economy.

But as we’ll discuss today, that doesn’t mean it’s all doom and gloom.

Let’s check in with the Power Gauge. We’ll see what it can tell us about the broad market…

After last week, you might think the Power Gauge would be screaming for investors to “run for the exits!”

But that’s not the case right now…

At Chaikin Analytics, we often use the SPDR S&P 500 Fund (SPY) to track the benchmark stock index. That way, we can get the system’s rating on the broad market – just like we can with all exchange-traded funds (“ETFs”).

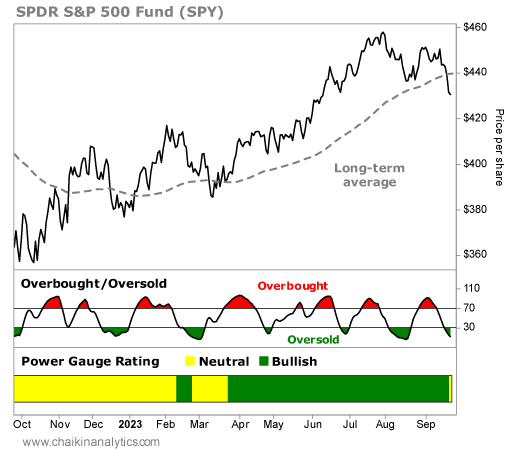

The following chart shows SPY’s performance over the past year. Take a look…

You should immediately take note of two things on this chart…

First, the broad market has moved up and to the right for the past year. The recent downturn hasn’t changed that fact. And the uptrend remains intact today.

After that, look at the Power Gauge Rating in the bottom panel. On the far-right side, you can see a slim bar of yellow. Specifically, our system now shows a “neutral+” rating on SPY.

A “neutral+” rating means the ETF is still fundamentally sound. However, it’s now trading below its long-term average. In the chart, you can see that change happened last week.

But look further back…

You’ll also notice that the S&P 500 moved meaningfully below its long-term average two other times over the past 10 months. It happened from late December 2022 through the early part of this year. And then, it happened again for a short period in March.

That hasn’t stopped the index from marching up around 13% since the start of the year.

Looking under the hood, SPY recently moved into “oversold” territory as well. That means investors have pushed stocks down quicker than the technical history on the chart supports.

So where does that leave us today?

We can’t get around the fact that stocks suffered last week. Every top-level sector pulled back. And most subsectors did, too.

Because of that, it makes sense to see a lot of investors running for the exits.

At the same time, it’s also worth noting that these kinds of pullbacks happen. We’ve already experienced two similar cases over the past 10 months.

The Fed paused its rate-hike cycle. But that doesn’t mean the market is done paying the price for high rates. In fact, some experts would argue that the worst pain still lies ahead.

So yes, the Power Gauge is telling us to be careful right now.

But importantly, we don’t need to abandon ship. And whatever happens from here, one thing is clear…

Opportunity remains in the market if you know where to look.

The Power Gauge rates roughly 90 stocks in the S&P 500 as “bullish” or better today. And I wouldn’t be surprised to see the system flip back to “bullish” on SPY in the weeks ahead.

I’ll be watching closely.

Good investing,

Vic Lederman