Editor’s note: Amid the market volatility this past week, we’ve noted that it still looks too early to throw in the towel on stocks.

And over at our corporate affiliate Stansberry Research, our friend Sean Michael Cummings is also saying not to give up on stocks just yet…

We’ve previously shared insights from Sean here in the Chaikin PowerFeed. And today’s essay from him just published in yesterday’s edition of Stansberry’s free DailyWealth e-letter.

In it, Sean shares how history indicates upside ahead after a big one-day drop like we just saw…

Earlier this week, a crash vexed investors all over the world.

And no, it’s not the crash you’re thinking of… I’m talking about a major service outage.

On Monday, the big three stock indexes fell about 3%. Retail investors loaded up their brokerage accounts to check the damage to their portfolios… and found themselves unable to log in.

As stocks fell, multiple trading platforms blinked out of service. Charles Schwab, Fidelity, TD Ameritrade, Vanguard, E-Trade, and Robinhood all suffered outages that lasted about three hours.

The reputations of these platforms have suffered. We may even see a class-action lawsuit as traders seek damages.

But despite all that, this brokerage outage likely worked in their favor…

That’s because panicking out of stocks on Monday was probably the wrong move. In fact, history shows the smarter choice was to just sit tight…

Folks weren’t just trying to check their balances when these platforms crashed on Monday. Those who made it through were also selling heavily.

According to strategists at JPMorgan Chase, retail investors ended the day with a net negative position of $1 billion. That’s more than two standard deviations below the norm.

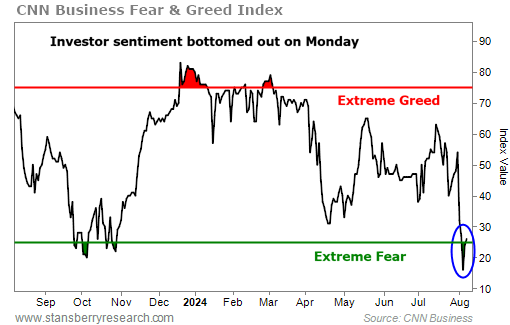

And it’s no surprise. Based on CNN Business’ Fear & Greed Index, investors were terrified.

This market measure combines seven indicators into a sentiment reading out of 100. A reading above 75 signals extreme greed. And a score below 25 signals extreme fear.

On Monday, this index hit its lowest level all year. Take a look…

Investors suffered a crisis of confidence. The S&P 500 Index experienced its worst day since 2022. And it ended the streak of complacency we’ve seen this year.

Monday’s crash was a drawdown for the record books. It’s extremely rare to see single-day dips of 3% or more in the S&P 500. They happen on fewer than 9% of days going back to 1950.

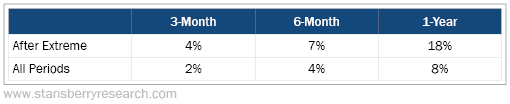

I wanted to put Monday’s move into context to see what it might mean for future returns. So I tested every one-day drawdown of 3% or more in the S&P 500 going back to 1950.

When stocks plunged on Monday, it may have felt like the start of a bigger crash… But history says the opposite is more likely. Take a look…

The 3% drawdown didn’t lead to future crashes. In fact, it pointed to outperformance over the next year.

U.S. stocks are one of the most solid investments you can make, returning 8% per year over the past 74 years. But that performance jumps dramatically when you buy after one-day dips of 3% or more…

Similar declines led to returns of 7% in six months. And they led to 18% returns over the following year – more than double the gains of a typical buy-and-hold strategy.

What’s more, the signal reliably forecast a good year for stocks. History shows positive returns in three out of four cases after six months. And in 82% of cases, the market was up one year later.

So even though stocks experienced a one-day tumble, history tells us it’s important to hang in there.

It may have been a gut-wrenching pullback. But the data shows it likely won’t last for long.

Good investing,

Sean Michael Cummings

Editor’s note: In DailyWealth, Sean and his colleagues cover more than just the day-to-day market opportunities and moves like this. They also share strategies to help their readers safely and steadily build a lifetime of wealth.

Just like the PowerFeed, DailyWealth publishes each weekday morning the markets are open. And it’s completely free. Learn more about DailyWealth and how to sign up for it by clicking here.