Folks, something serious has happened in the Power Gauge…

On August 2, just 12 days ago, the broad market S&P 500 Index fell into “neutral” territory in the Power Gauge. Today, it still holds a “neutral” rating in our system.

Now, if you’re a longtime reader, this shouldn’t surprise you. After all, the Power Gauge goes by the facts.

And these days, the facts that the broad market faces are pretty rough. The S&P 500, as measured by the SPDR S&P 500 Fund (SPY), is currently about 5% below its all-time high from last month.

That’s only about halfway to “correction” territory. But with its recent 13% decline from last month’s high, the Nasdaq Composite Index has suffered a correction.

And now, many investors are rightly spooked.

Today, I need to share an important message. You may see market turmoil. But as I’ll explain, the Power Gauge still sees opportunity ahead…

If a “neutral” rating on the broad market sounds concerning… I understand. After all, making money in the markets is easiest when you have a tailwind behind you.

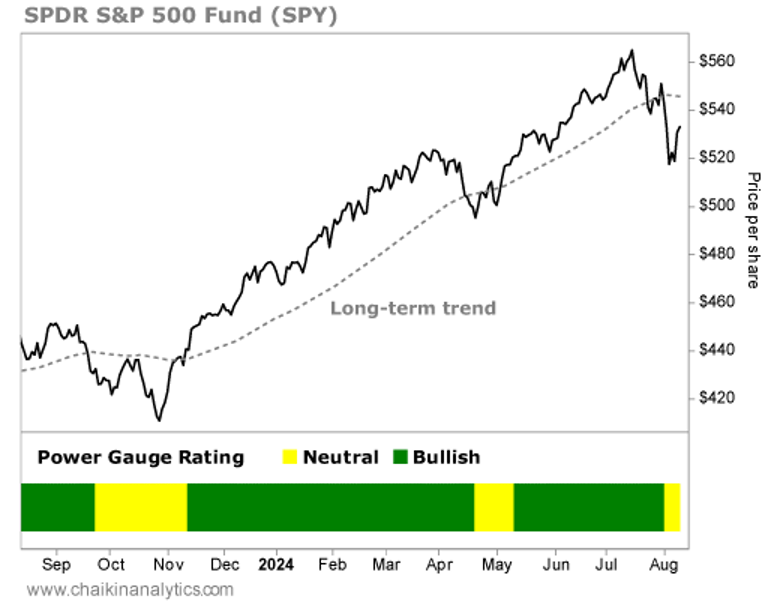

And stocks are taking a short breather right now. Take a look at this chart of SPY with some data from the Power Gauge…

The gray dashed line on the chart is the long-term trend line. You can see that the S&P 500 dipped below that level toward the end of July. Not long after that, it dropped from a “bullish” rating to “neutral” one.

But this is where it gets interesting…

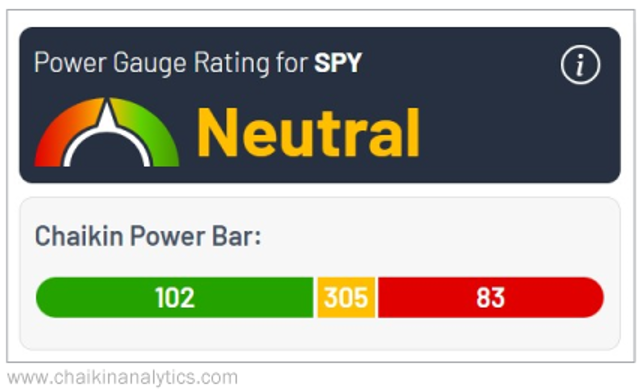

You see, 102 stocks in the S&P 500 currently earn a “bullish” or better rating in the Power Gauge. Meanwhile, 83 earn a “bearish” or worse rating. Take a look…

And when I looked at our system’s stock screener, I found that 18 stocks turned “bullish” just in the past week. That should really catch your attention.

But there’s more…

When I look at the broad sector-level exchange-traded funds (“ETFs”), I see even more opportunity.

The S&P 500 as a whole might be struggling. But six of the 11 top-level market sectors currently earn a “bullish” or “very bullish” rating from the Power Gauge.

Looking deeper, I also see opportunities in the subsectors. Nine of them earn a “bullish” or “very bullish” rating.

In fact, one of them has soared about 14% in the past month alone. And that’s compared with a roughly 4% decline in SPY.

My point should be clear…

We aren’t in an “everything goes up” market right now. You can’t just broadly buy and hope for the best.

But that doesn’t mean the market is out of opportunities. In fact, it’s quite the opposite.

Today’s market is bursting with opportunity. You just need a tool to help you know where to look.

Here at Chaikin Analytics, I obviously use the Power Gauge for that. Even in a down market, it helps me find the stocks that are soaring.

And more importantly, it helps me find the segments of the market that still have big tailwinds behind them… like the one that’s up 14% in the past month.

So don’t give up on stocks. A few down days in the market doesn’t mean the end of investing.

It simply means it’s time to put our tools – and our minds – to work.

Good investing,

Vic Lederman

Editor’s note: If you don’t already have access to our Power Gauge system, we’ve recently put together a special offer…

Right now, you can get a full year of access to the Power Gauge by signing up for Chaikin Analytics founder Marc Chaikin’s Power Gauge Report newsletter. That means access to our system’s ratings and data on more than 5,000 stocks. And if you aren’t satisfied within 30 days, you’ll be fully protected by our 100% cash-back guarantee.

Put simply, it’s risk-free to give Power Gauge Report and our Power Gauge system a shot. Learn more right here.