Adam Callinan and Matt Campbell knew they had a winner…

Their innovative product was an insulated, stainless-steel bottle with a detachable bottom.

It kept bottled beer cold. It offered protection if the user dropped the glass bottle. It even came with a built-in bottle opener.

Callinan and Campbell called their product the “BottleKeeper.” And in 2018, the two men appeared on the hit ABC show Shark Tank to pitch it to the potential “Shark” investors.

By that time, they had already notched $20 million in sales over the previous three years.

But the sales weren’t what caught the Sharks’ attention. The margins did.

Callinan and Campbell charged $34.99 per bottle. And it only cost $3.50 to make each one. That worked out to a gross margin of about 90%.

One key factor led to those huge gross margins…

The bottles were designed in the U.S. But they were made in China.

You see, Callinan and Campbell found a reliable Chinese supplier. And they got their insulated bottles made with the exact specifications from their design at a dirt-cheap price.

Despite the huge margins and strong sales, the business was still a startup…

Callinan and Campbell were pouring almost everything they made back into marketing the product. And at the time, they wanted a fresh infusion of cash to scale the business.

Their sales pitch ended up netting $1 million from the Sharks in exchange for a 5% stake.

When it comes to products on Shark Tank, the BottleKeeper isn’t an isolated case. And as I’ll explain today, it helps show the power of startup entrepreneurs “sourcing in China”…

Former NFL player Chris Gronkowski also pitched his idea on Shark Tank.

He developed the “Ice Shaker” workout bottle. It keeps contents cold for up to 30 hours. And it features a patented interior design to keep drinks properly blended.

Each bottle only costs $5 to make. And Gronkowski sells them for $25 each.

That’s an 80% gross margin.

Entrepreneur Justin Wang also shared his idea for the “LARQ” bottle on the TV show.

It’s a self-cleaning, insulated bottle designed to sanitize water in up to three minutes. It features a built-in ultraviolet light on the cap that activates when you press a button.

Because of its sanitizing features, the bottle had a steeper price of $95. But by sourcing the manufacturing to China, Wang’s costs came to about $40 per unit.

LARQ’s gross margins (around 58%) weren’t as generous as the BottleKeeper and Ice Shaker. But as the numbers show, Wang made a lot more in actual dollars per unit.

Folks, I hope these stories show you my point…

The economies of the U.S. and China are deeply entwined.

By sourcing production to China, U.S. entrepreneurs can boast big margins. And it’s why many Chinese stocks turn “bullish” even if most investors want nothing to do with them.

That’s true again today…

China’s “blue chips” are still turning around. They’re the companies most closely associated with these kinds of manufacturing success stories. And I believe that rebound will continue.

Meanwhile, the country’s tech stocks recently flipped into “very bullish” territory in the Power Gauge. And perhaps more importantly, they’re now beating the broad market.

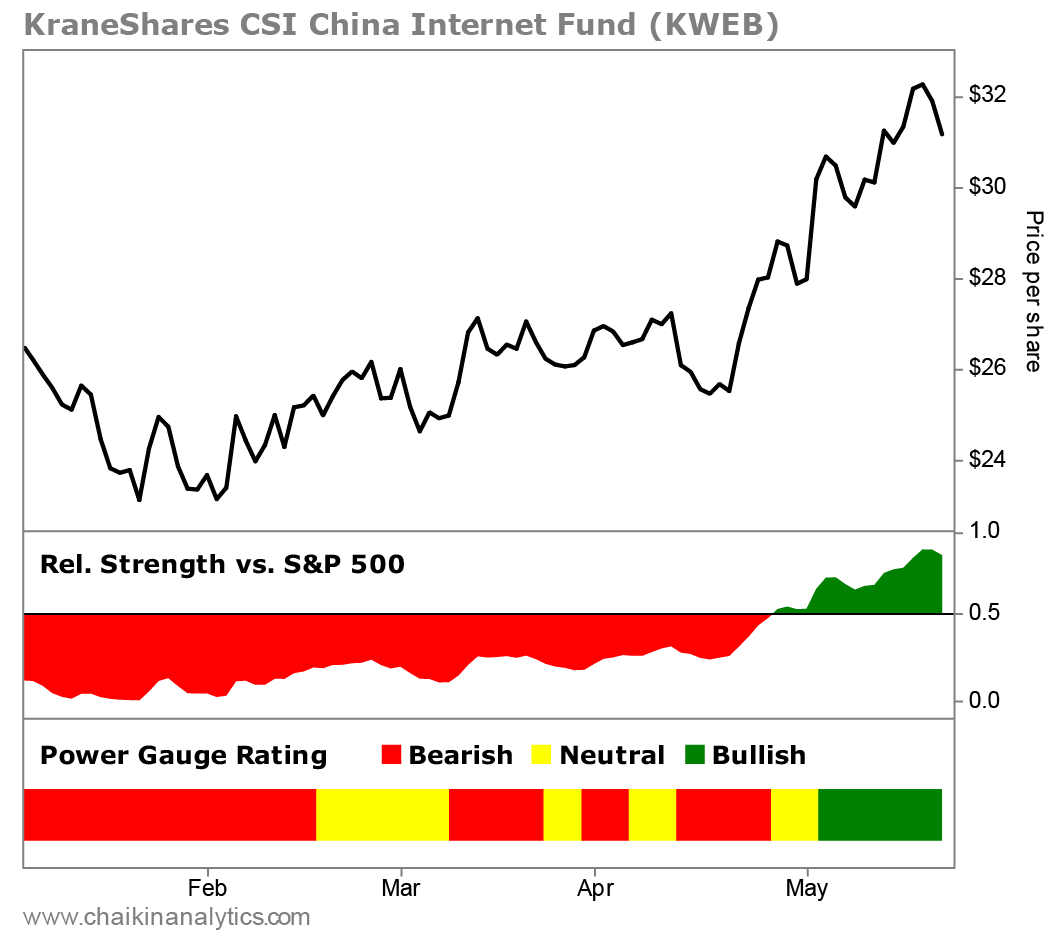

You can see what I mean through the KraneShares CSI China Internet Fund (KWEB). That’s one of the main exchange-traded funds that holds Chinese tech stocks. Take a look…

Notice that KWEB started outperforming the S&P 500 Index at the end of last month. It’s up around 30% since the start of February. The S&P 500 is only up about 8% over that span.

Then, KWEB flipped to “bullish” in the Power Gauge earlier this month. It still holds that positive rating today.

Put simply, the Power Gauge sees more upside ahead in this corner of the market.

So if you aren’t already paying attention, you should check out KWEB today.

Good investing,

Vic Lederman