It takes a lot for economies to keep growing quickly for decades…

Something usually breaks along the way. A recession, high inflation, or a financial crisis can halt breakneck economic progress.

But China did the unthinkable…

It grew its economy much faster and for much longer than any other country in modern history.

In 1980, it wasn’t even considered a major economy. Its total GDP was a mere one-tenth of the size of America’s GDP.

For the next 43 years, China grew its economy by nearly 10% per year on average.

That even surpassed the post-World War II economic expansion in the U.S. between 1945 and 1975. Everyone thought America’s nearly 7% annual growth over 30 years would never be beaten. They were wrong.

As of the end of 2023, China’s GDP stood at almost $18 trillion – nearly 59 times larger than it was in 1980.

It’s the world’s second-largest economy next only to the U.S. And by some estimates, China will be the largest by 2050.

But China’s stock market tells a different story…

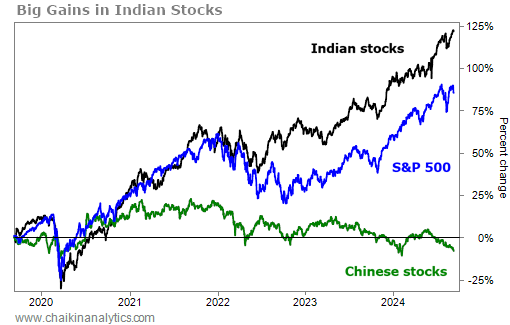

Despite China’s breakneck economic growth, its main SSE Composite Index has risen just about 250% over the past 30 years. Worse, it’s down about 7% in the past five years – even as China’s GDP expanded by roughly 28%.

So while the country is an economic powerhouse, investors haven’t been benefitting from it in recent years.

This leads me to another emerging market. This one is still just one-fifth the size of China’s economy – but it’s growing…

I’m talking about India.

India’s economy has been growing a little faster than China’s. Over the past five years, its GDP grew by about 32%.

But India’s stock market – the country’s main Sensex Index – is performing far better. Over the past five years, it’s up more than 120%. That’s even better than the S&P 500 Index. Take a look…

India’s market is doing so much better than China’s for a few reasons…

Today, India’s economy is growing much faster. Its average GDP growth for the past three years was about 8.2%. Over the same time frame, China’s was just 5.5%.

Unlike China, India isn’t locked in a trade war with the U.S.

In fact, India has become a preferred alternative to China for U.S. manufacturers. For example, Apple (AAPL) already produces 14% of its iPhones in India and plans to increase that figure to 25% by 2028.

India is also enjoying a real estate boom. Over the past decade, its residential-property prices have increased from 10% to 12% per year. Meanwhile, China’s real estate slowdown is now in its fourth year.

And for investors, a big change is pushing India’s exchange-traded funds (“ETFs”) ahead…

You see, India’s outperformance over China has to do with the way trillions of dollars in ETFs are allocated.

As you know, ETFs hold a basket of securities meant to track the performance of an index.

They’re a simple way for investors to own every company in an index without having to buy shares in each of the individual companies.

For example, the SPDR S&P 500 Fund (SPY) tracks the S&P 500 Index. It’s the biggest ETF in the world, with more than $550 billion in assets under management (“AUM”).

Buy one share of SPY, and you indirectly own a small piece of every stock in the S&P 500.

Globally, ETFs held a whopping $11.7 trillion in AUM as of early 2024.

As you would expect, most of these ETFs are focused on the U.S. It’s the largest stock market in the world.

But hundreds of billions of dollars are allocated to emerging markets like China and India. These emerging-market ETFs let investors diversify into faster-growing markets.

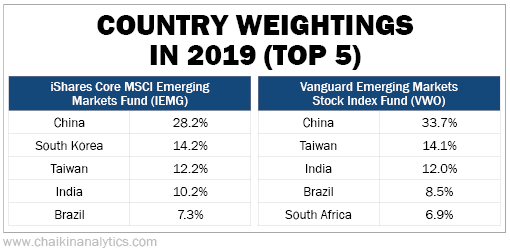

As the largest emerging market in the world by GDP, China dominated emerging-market ETFs five years ago. Take a look at the country weightings for two of the largest emerging-market ETFs at the beginning of 2019…

As you can see, China took the lion’s share of every dollar managed by these ETFs. By default, money that went into these ETFs mostly found their way into shares of Chinese companies.

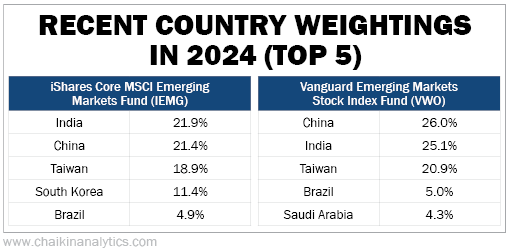

Five years later, we see a different story…

After doubling in allocation over the past five years, India is now just about as heavily weighted to these emerging-market ETFs as China is. That’s despite India having a much smaller economy.

Looking ahead, India is likely to go on to dominate emerging-market ETF allocation at the expense of China.

Bottom line, more money now is being directed to Indian equities out of the roughly $340 billion that U.S. investors are pumping into emerging markets.

Good investing,

Vic Lederman