Everyone is a “long-term investor”… until a stock heads south.

Then things get tricky. Does that mean you should buy more shares at the lower price? Sell the whole position? Or just sit there and stew on it?

When faced with a drawdown in a stock they own, investors are more likely to sell their winners and buy more of their losers. Psychologists call this the “disposition effect.”

When we have a gain, we get greedy. And we want to lock it in.

But when we have a loss, we become hopeful. We’re inclined to double down.

Famed investor Peter Lynch likened this to bad gardening. In his famous book, One Up on Wall Street, he said “selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

But when a stock goes down, we have to make decisions in a vacuum. No company is going to hold your hand… or give you a heads-up to sell.

And in that void, emotions take over.

So how can we make rational decisions? We have to listen to the market. And luckily, the Power Gauge is here to help…

For decades, “buy and hold” was gospel in investing.

Big names like Jack Bogle, Warren Buffett, and even Benjamin Graham all lived by it.

And it worked. Companies that did well one year tended to do well the next. And even if you were wrong, the market bailed you out. A strong market tended to lift weaker stocks.

But blindly following the “buy and hold” mantra can be dangerous.

A great example of this within the S&P 500 Index is food giant Kraft Heinz (KHC)…

Back in 2015, Kraft and Heinz merged to form one of the largest food companies in the world. Warren Buffett loves it. Berkshire Hathaway (BRK-B) still holds a roughly 27% stake in the company.

Kraft Heinz sells lots of brands we all know. For example, aside from its well-known namesake ones, it also owns brands like Maxwell House coffee, Oscar Mayer hot dogs, and Capri Sun juice.

Kraft Heinz is a household name. It makes products everyone recognizes. So you would think the business would be stable.

But that’s not the case. Since the merger, the company has had huge problems.

First, it had too much debt. Then came healthy eating. Processed cheese and ketchup weren’t part of that trend.

Now, many supermarkets are increasingly focused on private-label products. The stores own and sell these goods themselves.

Private labels are cheaper. And in today’s cost-conscious world, consumers are going cheap.

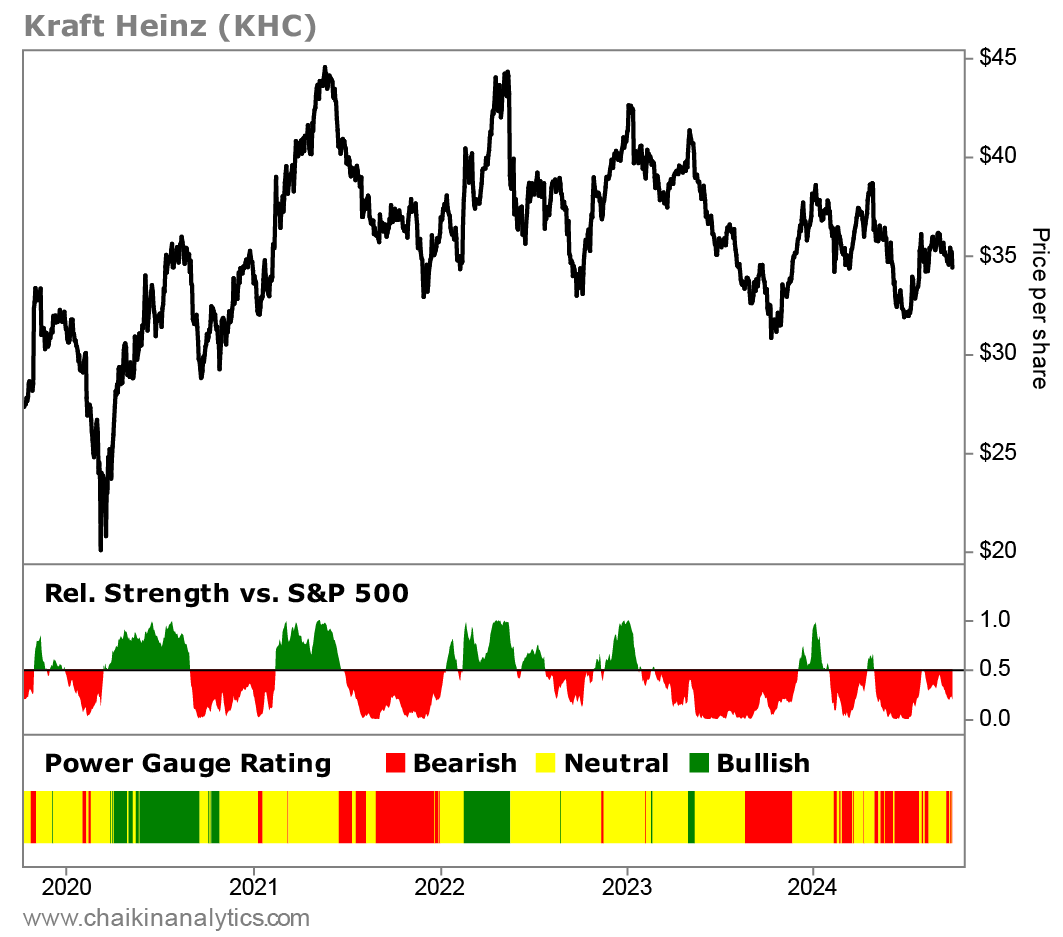

When it comes to the stock, a look at the Power Gauge shows how the company’s struggles have played out in recent years…

In short, things haven’t looked so great over the past five years. As you can see, the stock has mostly held a “neutral” or worse rating in the Power Gauge. Right now, it has a “very bearish” rating.

Meanwhile, its relative strength versus the S&P 500 has been weak overall. Yes, KHC shares are up about 29% over the past five years. But the broad market is up a whopping 96% over that same time frame. That’s massive underperformance.

So, there’s not much winning here for Kraft Heinz. But the company is far from alone when it comes to weak stocks in the S&P 500…

Based on the SPDR S&P 500 Fund (SPY), the Power Gauge is “bullish” on the broad market right now. And it gives 152 holdings in SPY a “bullish” or better rating. But amid all those holdings with great ratings, our system also sees 62 “bearish” or worse stocks.

Put simply, it’s not enough to dump money into a big-name company that seems “good” on the surface… and then hope for the best.

Today’s market demands a more active approach to find the traps. “Buy and hold” just isn’t working like it used to.

Good investing,

Joe Austin

Editor’s note: This kind of situation is exactly why our one-of-a-kind Power Gauge is so useful. With its ratings system, the Power Gauge helps find which stocks look poised for big upside… or big downside.

Right now, you can get a full year of access to the Power Gauge and its ratings on more than 5,000 stocks by signing up for Chaikin Analytics founder Marc Chaikin’s Power Gauge Report newsletter. And if you aren’t satisfied within 30 days, you’ll be protected by our 100% money-back guarantee.

Find out how to get started right here.