You might have been hearing about a rising problem for electric and hybrid cars…

I’m talking about battery fires.

Specifically, the lithium-ion batteries in these vehicles are inherently fragile.

And when they go wrong… they go seriously wrong.

That’s because lithium can spontaneously combust in open air. And it reacts violently with water. Worse still, the smoke these fires produce is toxic.

That means trying to put out a lithium-battery fire can be a disaster. And we’re increasingly seeing that in the news…

In July, a truck carrying lithium batteries crashed on Interstate 15 in California during the rush-hour commute. If it hadn’t been for the batteries, authorities might have cleared the crash quickly.

Instead, it devolved into what one person described as a “traffic apocalypse from hell.” And it was a long one, too…

It took crews 44 hours to reopen the road.

But that’s just one example. There have already been numerous lithium fires on our roads this year. And many of them have been equally serious.

Back in May in Arizona, a Waymo electric vehicle (“EV”) caught fire. It took the response and effort of more than 50 firefighters to solve the problem. After a week, they finally declared the fire was fully extinguished.

If it sounds crazy… that’s because it is. But this is the reality facing automakers as they try to transition to EV manufacturing.

Now Stellantis (STLA), which owns the famed Jeep brand, is in the crosshairs. So amid this new development, let’s see what the Power Gauge has to say about it…

Folks, we’re in a crazy news cycle right now. So you might have missed this story earlier this week.

But Stellantis is facing a major hurdle. Tens of thousands of its plug-in hybrid vehicles have a potential fire risk. As the company said in a press release on Monday…

A routine company review of customer data led to an internal investigation that discovered 13 fires. All vehicles were parked and turned off.

As a result, Stellantis is recalling nearly 200,000 of its Jeep Wrangler and Jeep Grand Cherokee vehicles. It’s a disaster for consumers.

The company is effectively telling owners that the vehicles are useless until they’re fixed. As it noted in the press release…

Owners are advised to refrain from recharging. Out of an abundance of caution, the company is also advising owners of these vehicles to park away from structures or other vehicles until the remedy is obtained.

This is obviously bad for Stellantis. But the Power Gauge spotted something wrong with the company months ago. Take a look…

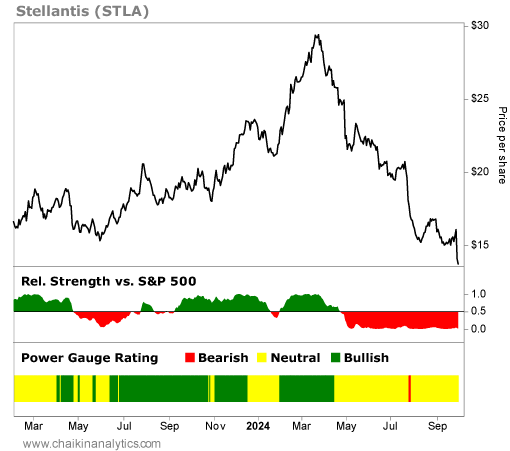

As you can see, the Power Gauge was mostly “bullish” on Stellantis as the stock soared last year.

But just after the peak this past March, our system flipped to “neutral.” You can also see that Stellantis has remained in “neutral” or worse territory since then.

And take a look at the first panel below the chart…

It shows the stock’s relative strength versus the S&P 500 Index. You’ll notice that the flip to “neutral” happened around when Stellantis’ relative strength collapsed.

Put simply, one glance at the Power Gauge made it clear that something had changed. Our system started flashing caution for Stellantis months ago. And it’s still cautious on the stock today.

Worse still, the automotive industry group is weak as a whole in the Power Gauge.

So yes, recalls and fires aren’t unique to Stellantis. But looking at the whole picture right now, I would recommend avoiding this stock.

Good investing,

Vic Lederman