Editor’s note: The Power Gauge is as bearish as it gets on oil right now…

And rightly so. So far in 2024, the energy sector is only up about 5% compared with the S&P 500 Index’s roughly 21% gain. It’s the worst-performing sector this year.

But that doesn’t mean it’s going to stay down forever…

Today, we’re sharing an essay from our friend Brett Eversole over at our corporate affiliate Stansberry Research. It originally published in the September 26 edition of his free DailyWealth e-letter.

In it, Brett explains why he thinks a turnaround in oil could be closer than many investors realize. It’s a contrarian take – but Brett specializes in this kind of approach. And it’s always good practice to listen to the other side of the analysis from smart folks in the room…

Things couldn’t get much worse for fossil fuels…

The clean-energy revolution is reducing demand for oil and natural gas in the long term. Meanwhile, fears of a global recession are higher than ever… weighing on demand in the short term.

Put it all together, and it’s a tough time to invest in energy. It’s the worst-performing sector in 2024 so far. And oil prices recently hit their lowest point since 2021.

Now, everyone has given up on oil. Sentiment recently fell to one of its lowest levels in recent history. But don’t let that fool you… If history is any guide, a major rally is about to begin.

Let me explain…

Commodity prices move based on supply and demand. But it’s not just today’s environment that counts – it’s also the expected supply and demand in the future.

The market is usually pretty good at guessing these things. But expectations can be wildly wrong at extremes. And when they are, you can set yourself up for profits as an investor.

That’s where the oil market is now. Folks have good reasons to be pessimistic. But today’s level of pessimism is simply overkill when you compare it with history…

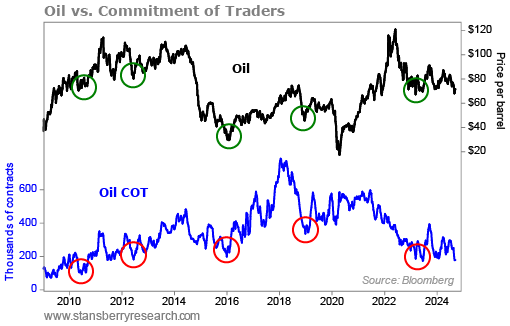

We can see it by looking at the Commitment of Traders (“COT”) report for oil. This weekly report shows us what futures traders are doing with their money. And when these folks are all betting in one direction, it’s a strong contrarian signal.

That’s the exact situation we have today. Futures traders are near the most bearish we’ve seen in the past 15 years. Take a look…

Futures traders are the most bearish they’ve been on oil since June 2023. And before then, we hadn’t seen this kind of sentiment since 2010.

Importantly, the chart shows that similar COT lows have a history of happening at bottoms for oil. And once the sentiment bottom is in, oil tends to soar.

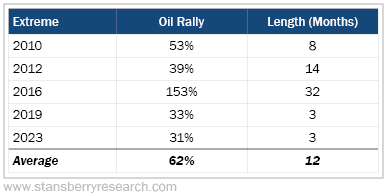

You can see what happened after the circled sentiment lows in the table below…

The relationship here is clear… When futures traders give up on oil, a major rally begins. The only question is whether it will be a quick move higher or a multiyear surge.

We’ve seen two rallies that each lasted more than 12 months. Those led to average gains of 96% for oil. The other three all lasted less than a year and led to average gains of 39%.

Regardless, we know one thing for certain… Today’s low oil prices and bearish sentiment won’t last for long. And despite how crazy it seems today, history suggests we’ll likely see $100 oil at some point in the next year.

Few investors think that’s possible today. But as a contrarian, you’d be smart to bet against the crowd… and bet on much higher oil prices.

Good investing,

Brett Eversole

Editor’s note: Brett consistently takes a contrarian approach to investing. And over at DailyWealth, he and his colleagues are always on the lookout for these kinds of setups to share with their readers.

Just like the Chaikin PowerFeed, this e-letter publishes every weekday morning. And it’s completely free to receive it. Learn more about signing up for DailyWealth right here.