It’s one of the most hated markets in the world…

For several years, investors have been wary of China. They’re worried about the country’s growing geopolitical rivalry with the U.S. and its property market crash.

Many folks even consider China uninvestable.

In fact, JPMorgan Chase (JPM) recently ditched its “buy” recommendation for Chinese stocks. It fears a worsening trade war with the U.S.

But a major change for Chinese stocks happened earlier this week.

The Chinese government announced a series of measures to help its economy and stock market. And these are strong…

One is a large 50-basis-point (“bps”) cut to banks’ reserve requirement ratio (“RRR”).

This refers to how much in deposits that a bank must keep as reserves and can’t lend out to borrowers.

That 50-bps cut alone is enough to free up an extra $140 billion-plus in deposits to be lent out. And the Chinese government hinted at a possible additional cut of 25 to 50 bps later this year.

The support package also includes a 50-bps cut for average interest rates for existing mortgages. Another measure is a reduction in the minimum downpayment ratio on second mortgages from 25% to 15%.

Meanwhile, China went a step further to shore up its stock market…

Its central back set up a more than $70 billion “swap facility” that brokers, mutual funds, and insurers would be able to tap to buy up mainland-listed Chinese stocks. It’s a huge figure for China’s market. And officials said that they could at least double the amount if necessary.

Again, these are massive stimulus measures. And Chinese stocks leaped on the news.

The country’s main SSE Composite Index soared more than 4% on Tuesday. And it has kept moving higher since then.

Now, this isn’t the first time the Chinese government has tried to help its ailing markets…

It has put forth several supportive measures in the past. But they were introduced slowly. And their effects eventually fizzled out.

This is the first time the government has introduced a handful of supportive policies with a clear intention of boosting its stock market.

It’s China’s version of quantitative easing. And it’s already working to boost confidence in the country’s stock market.

Of course, we’ll have to wait and see if this translates to gains in the real economy…

It will take some time before lower rates and smaller downpayments translate to stronger housing demand.

Chinese businesses won’t immediately take on new loans simply because banks are now able to lend out $140 billion-plus more to potential borrowers.

But it is clear that the Chinese government is now getting serious about helping its stock market and economy.

However, that doesn’t mean it’s time to immediately rush into Chinese stocks…

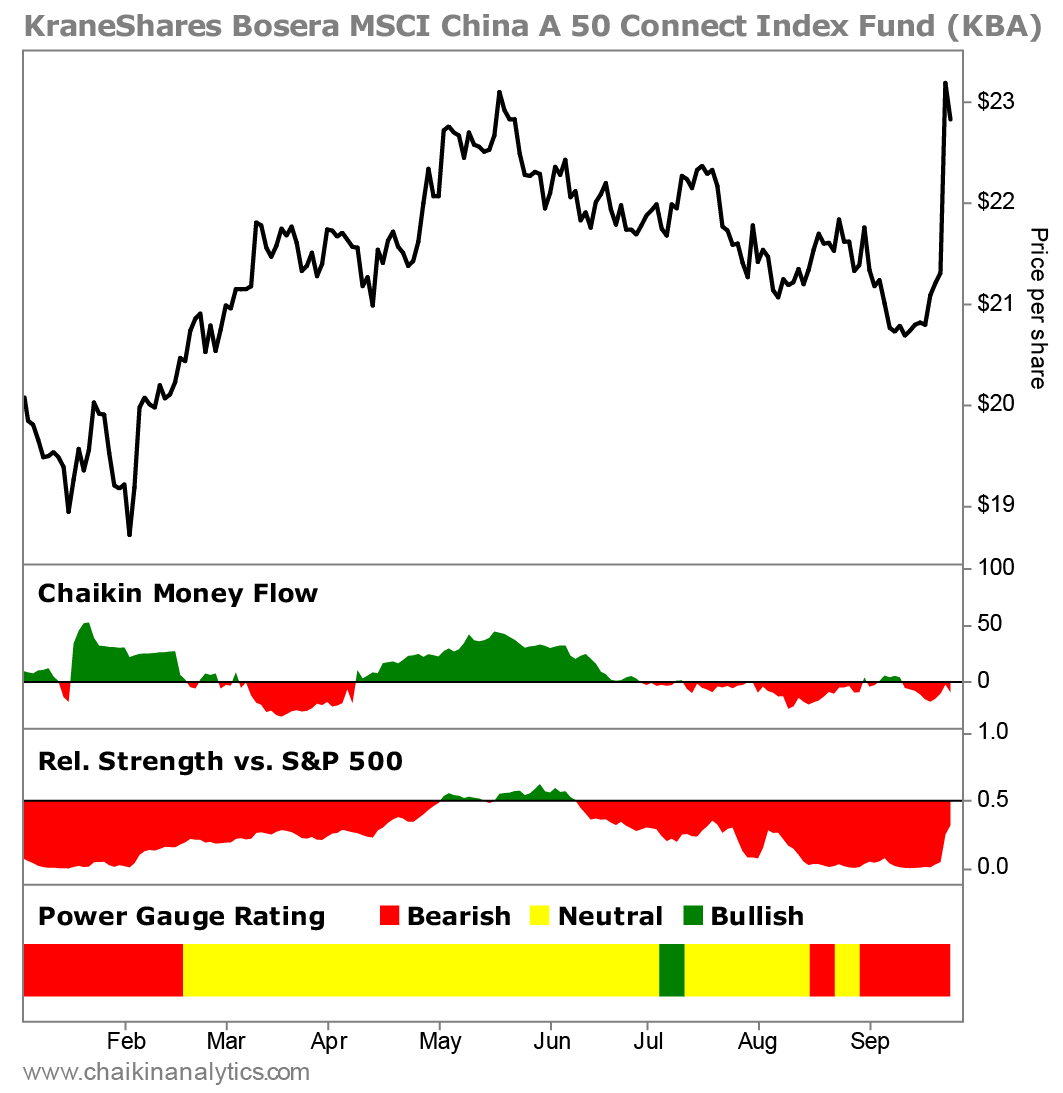

In the Power Gauge, we can take a look at Chinese stocks through the KraneShares Bosera MSCI China A 50 Connect Index Fund (KBA). This exchange-traded fund (“ETF”) provides exposure to the 50 largest securities in China’s mainland markets that can be traded by overseas investors.

Take a look at this year-to-date chart of KBA along with some data from the Power Gauge…

Right now, KBA gets a “very bearish” rating in our system. And you can see that it has been in “neutral” or “bearish” territory for most of this year.

You can also see the big move higher this week after the news on the stimulus measures. However, KBA’s Chaikin Money Flow indicator – which measures “smart money” trading activity on Wall Street – has still been weak.

Meanwhile, the fund’s relative strength versus the S&P 500 Index has also been weak recently.

But given the big developments, it’s still worth keeping Chinese stocks on the radar…

China has many other tools left at its disposal to stimulate its economy and fire up its stock market. Its government could just be getting started.

Again, this group of stocks is still among the most hated in the market. So all it takes is a small shift in sentiment – going from “hated to less hated” – to spark a powerful rally.

Good investing,

Vic Lederman