“No tenants or toilets” is a popular selling point for real estate investment trusts (“REITs”)…

After all, the original REIT was created so that ordinary folks could own real estate – without having to do the dirty work.

Put simply, these companies own or operate different types of real estate. So by investing in one, you get to earn real estate income. But you don’t have to buy or manage the properties themselves.

Investors love REITs. According to the National Association of Real Estate Investment Trusts (“NAREIT”), there are more than 225 publicly traded REITs in the U.S. They have a total market capitalization of more than $1 trillion.

They’re popular abroad, too. Globally, there are 940 REITs with a total market capitalization of around $2 trillion.

But despite this popularity, REITs have been on a roller-coaster for the past couple of years…

It all began in 2022 when the Federal Reserve raised interest rates. Rate hikes were a double whammy for REITs.

Seemingly overnight, regular savings accounts paid 5%. And not-so-risky bonds paid 4%. REIT yields didn’t look so attractive.

Higher rates hit property values, too.

REITs own tons of commercial real estate (“CRE”). As offices shut down and millions of folks started working from home during the pandemic, CRE demand took a massive hit. Even as the pandemic receded, CRE still hadn’t bounced back after the disruptions.

We can see the beating that real estate took through the Real Estate Select Sector SPDR Fund (XLRE). As the name implies, it’s an exchange-traded fund (“ETF”) that tracks the real estate sector. And in 2022, XLRE collapsed by 29%.

But recently, REITs have been making a bit of comeback…

XLRE is up around 12% so far in 2024. And it has done particularly well since the market’s rotation in July.

Since July 1, XLRE has jumped roughly 18%. Over the same time frame, the S&P 500 Index is up around 4%.

That’s a big turnaround. So what has been driving it?

In short, the prospect – and now the reality – of lower interest rates. On Wednesday, the Fed made its long-anticipated rate cut.

Lower rates mean that declines in property values may have slowed. And REIT dividends could look more attractive.

But when you invest in stocks, dividends aren’t the only source of return. And because of that, even if you love dividends, there might be better choices than REITs.

So let’s take a closer look…

Keep in mind that REITs have been around since 1960. Along with mutual funds, ETFs, 401(k)s, and health savings accounts, they’re among the handful of investment vehicles created by the U.S. Congress. The original idea was to give small investors an opportunity to invest in large CRE projects.

Across the years, the REIT industry blossomed. Currently, there are 13 categories of REITs. If something sits in the ground and generates rent, you can turn it into a REIT.

Investors love REITs because they pay dividends. At the corporate level, REITs aren’t subject to corporate income taxes if they distribute 90% of their net income to shareholders.

So all REITs do. But in the long run, this tends to limit the return on a REIT…

As you know, stocks have two sources of return – capital appreciation and dividends. Good companies compound capital over time. And they return excess capital to shareholders via dividends.

With REITs, investors get a return on their capital (the dividend)… but not much capital appreciation. That’s because all those earnings get paid out every year.

Turning to the Power Gauge, XLRE gets a “very bullish” rating right now. And the fund has 16 holdings with “bullish” or better ratings compared with a single “bearish” one. The other 14 holdings are “neutral.”

Meanwhile, of the 16 stocks with “bullish” or better ratings, 13 are REITs.

But here’s the thing…

These 13 stocks have an average yield of about 3.5%. That’s the same as the current yield on the S&P 500.

And since REITs don’t have the strong capital appreciation, it begs the question: Might there be something better?

Well, for one, consider high-dividend-paying stocks.

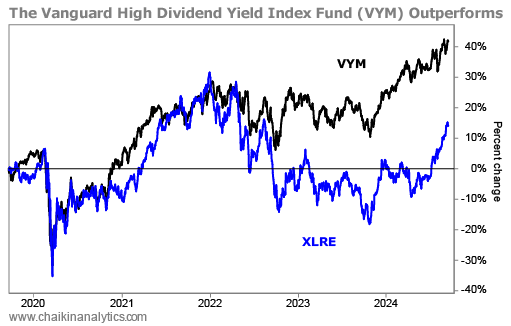

The chart below shows the performance of the Vanguard High Dividend Yield Index Fund (VYM) and XLRE over the past five years. VYM tracks the performance of stocks that pay above-average dividends. As you can see, VYM’s performance isn’t just better… The fund is less volatile, too. Take a look…

Furthermore, VYM earns a “bullish” rating in the Power Gauge right now. That means our system sees upside ahead for the fund.

So I’m not against REITs. But you need to choose them wisely. And consider some high-dividend-paying stocks, too.

In either case, you won’t have “tenants or toilets” – or need to worry about the dirty work.

Good investing,

Joe Austin