It’s one of the most widely talked about stocks on the market…

And it’s one of the so-called “Magnificent Seven” giants…

But it hasn’t made a new high in an astounding 31 months.

I’m talking about electric-car king Tesla (TSLA). And considering all the hype around Magnificent Seven in the financial media, that might be surprising to hear.

This is something that deserves a closer look. So today, let’s do that with the help of the Power Gauge. And we’ll also see what it means in a bigger context…

Before we go on, remember that the Magnificent Seven are the mega-cap tech stocks that replaced Wall Street’s previous favorite acronym – “FAANG.”

Aside from Tesla, the rest of the group includes Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), Meta Platforms (META), Microsoft (MSFT), and Nvidia (NVDA).

These stocks also dominated the market last year. Their average gain was an astounding 111% in 2023. And Tesla was one of three in the group that soared more than 100%.

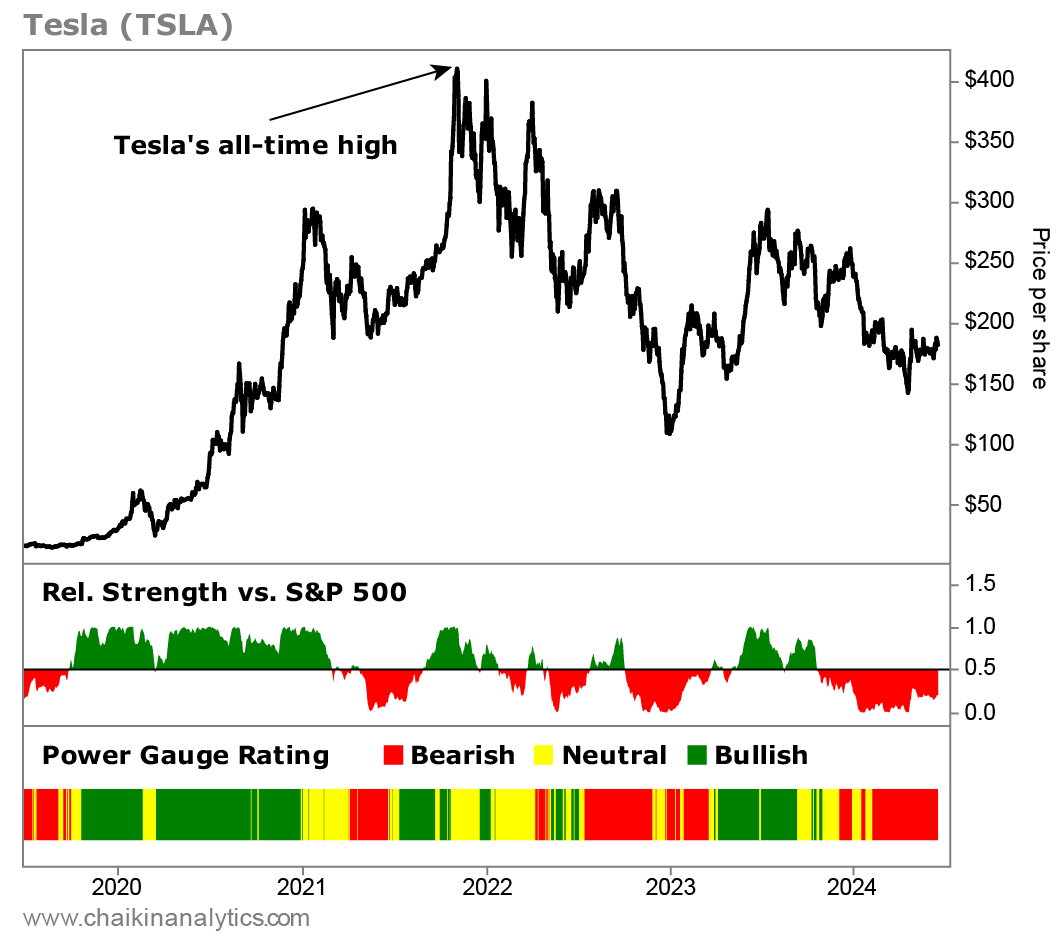

So it might be surprising to hear that the stock hasn’t made a new high in more than two and a half years. But take a look at the chart…

That’s right, Tesla may be the most talked-about name in the automotive industry these days. And it’s the clear leader in American electric-car sales.

But over the long term, its share price is suffering. The stock hit an all-time high in November 2021 at about $410 per share. Today, TSLA shares trade for around $183.

And in the first panel below the price chart, you’ll notice our proprietary measure of the stock’s relative strength versus the S&P 500. As you can see, this measure is sharply in the red.

That means the stock has been underperforming the broad market. In fact, it’s down a staggering 26% this year. Meanwhile, the S&P 500 has soared about 15% so far in 2024.

Not surprisingly, when we put it all together, Tesla earns a “very bearish” rating from the Power Gauge today. And as you can see in the bottom panel below the chart, the stock has spent most of this year in “bearish” or worse territory.

Folks, this is a big deal…

As my colleague and Chaikin Analytics founder Marc Chaikin explained on Friday, the market is highly concentrated right now. And investors are focusing on the names at the top.

But Tesla is the perfect example of a big name that’s struggling. That makes the takeaway clear…

Despite the overall market’s surge in 2024, now is not the time to simply buy up the big names and hope for the best.

Today’s market demands a conscious and active approach.

That means that now, more than ever, picking the right stocks is paramount. And knowing what to do when that market concentration shifts could be the difference between making huge returns… or seeing your portfolio wither.

And that’s exactly why Marc is going on camera this coming Wednesday, June 26…

During a special event, he’ll be sharing what could be the single most profitable strategy he has ever shared with readers.

In fact, it’s one that has a historical record for outperforming the rest of the market in financial environments just like the one we’re seeing right now.

Marc will explain everything you need to know during the big event. It all kicks off on Wednesday evening at 8 p.m. Eastern time – and it’s completely free to attend.

Learn more and register to attend right here.

Good investing,

Vic Lederman