Take a guess…

How many new “housing units” do you think San Francisco approved permits for this year?

To clarify, that’s the government’s term for new builds. And it includes single-family and multifamily projects.

So as you would expect, a single-family home is one unit. And an apartment building with 100 apartments counts as 100 units.

With that understood, you would probably guess that a big, expensive city like San Francisco would be building a lot of housing.

After all, it’s famously known for its housing shortage. And that shortage is creating problems for just about everyone who lives there.

But you would be wrong…

According to recent federal data, San Francisco has only approved 16 housing units so far this year.

Folks, that’s absurd.

But it’s not just San Francisco…

As I’ll explain today, the reality is that America is building homes like it’s the 1990s. And that’s not going to cut it to solve the housing shortage…

There’s no getting around the fact that America is low on new housing. In fact, earlier this year, analysts at Moody’s found that we’re still short roughly 1.2 million single-family homes.

And that’s despite a hot year for homebuilders in 2023. As the team at Moody’s put it, “one good year does not solve America’s housing shortage.”

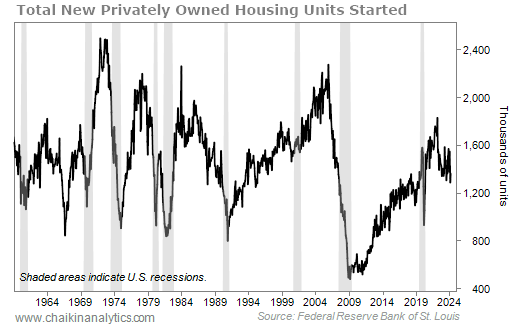

The chart below shows the total number of new privately owned housing units started. That means the data covers everything from new single-family homes to new apartment buildings.

It explicitly avoids counting public works projects to build housing. That’s what the “privately owned” part is about.

And as you can see, America just isn’t building as much housing as it used to…

In fact, in the 1990s, the average annual rate of new privately owned housing units started was just more than 1.37 million. Today, based on the most recent monthly data, we’re at about 1.36 million units.

So it’s true… America really is building homes like it’s the 1990s. And as you would no doubt expect, considering the increase in population, that’s a big issue.

In 2000, the U.S. Census Bureau counted fewer than 282 million residents. Today, the U.S. population is approaching 337 million people.

The shortfall of homes creates a tailwind behind the housing market – and homebuilders specifically.

However, that doesn’t mean you should run out and immediately pour money into homebuilders…

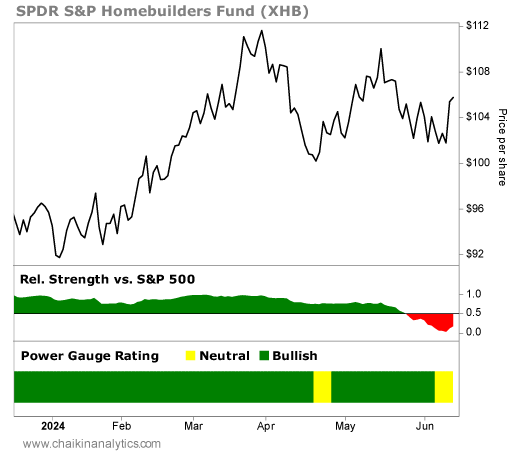

In the Power Gauge, we track the subsector using the SPDR S&P Homebuilders Fund (XHB) And XHB is taking a breather right now.

It’s true that the fund has soared nearly 10% over the past six months. But take a look at the first bottom panel in the chart below. As you can see, XHB’s relative strength versus the S&P 500 Index has weakened in recent weeks…

That means XHB is currently underperforming the broad market.

So what does this mean for us as investors?

It simply means even macroeconomic tailwinds can’t overcome a technical downturn. And that’s why the Power Gauge utilizes both fundamental and technical analysis in its ratings.

For now, I’ll be watching this segment of the market closely. And I recommend you do the same.

As long as America is building like it’s the 1990s… there’s going to be a lot of housing demand here in the present day. I wouldn’t bet on XHB to underperform for long.

Good investing,

Vic Lederman