The COVID-19 pandemic crippled the global supply chain…

Here in the U.S., we experienced mass shortages in everything from food to cars. And roughly three years later, it’s still hard to find certain items (at affordable prices, at least).

For one, semiconductors (or “chips”) are still in short supply…

Part of the problem is that the U.S. currently relies on other countries to produce most of the needed chips. So during the pandemic, global chip shortages wrecked our supply chain.

Without enough chips to go around, companies had no choice. It forced them to make fewer cars and electronic devices.

These chip shortages provided a big wake-up call for Americans…

Now, with the help of federal legislation, the chipmaking process is coming home.

With the Power Gauge’s help, I’ll explain today why this move is important…

In short, it’s now kick-starting a multibillion-dollar industry inside our borders. And as you’ll see, it’s growing into a huge opportunity for investors…

East Asia currently controls 75% of the global chip supply. And more specifically, the U.S. imports 90% of its chips from Taiwan.

So it’s no surprise that chips were hard to find when the pandemic closed international borders. And to put it bluntly, something like that can’t happen again…

Today, more than ever, the U.S. needs a reliable chip supply.

It’s important if our country hopes to keep competing for dominance in the global economy. And it’s critical for the government to ensure national security…

All U.S. defense systems rely on chips. And we can’t risk getting cut off from them due to a fragile global supply chain.

The recent tensions between China and Taiwan have only solidified this point.

In fear of a further chip shortage, Congress passed the CHIPS and Science Act last August…

Through this legislation, the government will invest billions of dollars to bring chipmaking back to U.S. soil. Specifically, around $53 billion will go straight to domestic companies.

And U.S. producers have another big advantage over their foreign competitors…

Many base materials used for chipmaking (such as silicon) are already mined in the U.S.

By the time a completed chip lands in the U.S., it has traveled nearly 35,000 miles. And it has crossed 70 international borders. Soon, that won’t need to happen anymore.

Domestic producers will be able to complete the entire process right here at home. That will significantly shorten the path from the producers to the end users.

Now, when the government starts writing checks, it’s time to pay attention. Politics aside, Uncle Sam can – and does – make big waves in the markets. So it’s wise to follow him.

Fortunately, we can use the Power Gauge to spot the market’s best trends. And even today, seven months after Congress acted, a huge opportunity clearly remains in this space…

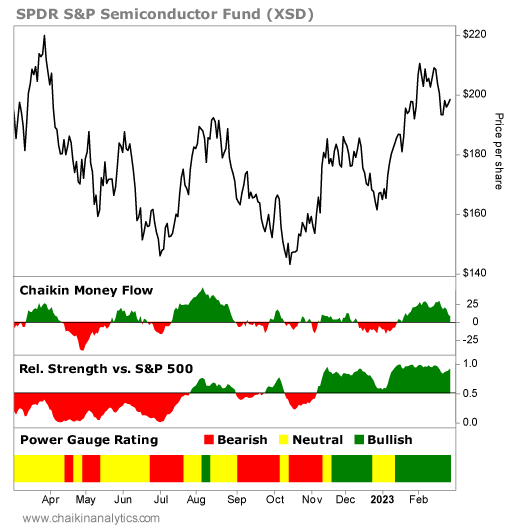

The SPDR S&P Semiconductor Fund (XSD) is an easy way to track this industry. This exchange-traded fund includes about 40 chipmakers and related companies.

XSD is up roughly 20% so far this year. And even better, the Power Gauge is still “bullish”…

You can also see that the “smart money” has flowed into this space since early January. That’s evident through the Chaikin Money Flow indicator in the bottom panel.

Regular readers know that it’s wise to follow the smart money. Large institutional investors – such as pension funds, mutual funds, and hedge funds – make up this group. They’re the opposite of the “dumb money” – small-time traders who just want to get rich quick.

Unlike the dumb money, these Wall Street pros are right more often than they’re wrong. So when they bet on a developing trend like this one, it’s further evidence of an opportunity.

When we put everything together, it’s clear that this industry is primed to keep soaring…

The U.S. is moving away from foreign chip production. It’s expanding operations at home.

And as you can see, the Power Gauge points to further upside in these companies today.

Good investing,

Briton Hill