Most of us wouldn’t go into a casino and put 30% of our money on the first hand…

But when you’re “passive” about your investing, that’s exactly what you’re doing.

You see, many exchange-traded funds (“ETFs”) are passive. You don’t have to select the stocks yourself or worry about rebalancing. Instead, the ETF puts together the basket of stocks for you.

But as I’ll explain today, in most cases, you’re actually making an “active” bet on size and momentum. That’s because many ETFs select stocks based on a simple set of rules…

One of the easiest sets of rules is “market capitalization weighting.” That’s when the biggest stocks make up the largest share of an index or ETF’s holdings.

This set of rules can lead to trouble for investors, though…

For example, at the end of 2021, technology stocks made up nearly 30% of the market-cap-weighted S&P 500 Index. So if you only invested in an S&P 500-tracking ETF, like the SPDR S&P 500 Fund (SPY), tech stocks would’ve made up almost a third of your portfolio.

Maybe you didn’t actively choose to be invested 30% in the tech sector. But that’s the passive bet you made. And as I showed you on January 27, that proved dangerous as tech stocks sold off.

This problem can pop up in your portfolio in other, less obvious ways as well…

Let’s assume you read my essay and realized you were overweight tech giant Apple (AAPL). So you sold some AAPL shares to reduce your risk. You think you’re in the clear, right?

Wrong.

If you’re investing with passive accounts, your portfolio includes “sleeper agents”…

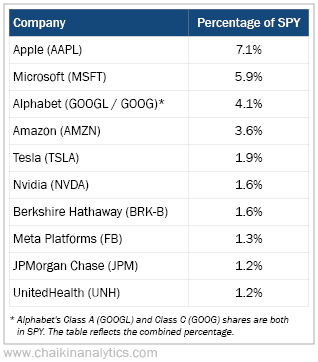

Check the holdings of your retirement accounts. If they hold a large percentage of the most popular ETFs, like SPY or other index-tracking funds, you could be overweight some big companies today. For example, here are SPY’s top 10 holdings as of mid-February…

Just by investing in SPY, your portfolio has already inched you a lot closer to overweight Apple than you might’ve realized. So you could be taking on more risk than you want.

Now, that isn’t a bad bet to make if it works out. But it’s important to understand that passive ETFs can lead you into a highly concentrated bet on a small handful of companies.

You should be aware of that risk so you don’t get surprised down the road. Make sure your accounts – including the “passive” ones – haven’t led you into an active, oversized bet.

The bottom line is that you want to always know and understand what bets you’re making as an investor. You never want to go in and throw 30% down on the first hand.

Good investing,

Karina Kovalcik