Sure, the benchmark S&P 500 Index is up around 19% so far this year…

But don’t let that fool you.

The S&P 500 lost about 20% of its value in 2022. And you’ll likely recall that tech stocks fared even worse. The tech-heavy Nasdaq Composite Index fell 33% last year.

So yes, it’s true that the market has rallied significantly this year. But we still haven’t erased all the pain of 2022. Neither the S&P 500 nor the Nasdaq have eclipsed their 2021 highs.

Because of that, many investors are still in “wait and see” mode.

However, as I’ll explain today, that could soon change…

You see, a record level of cash is sitting on the sidelines right now. In fact, depending on how you measure this cash pile, it could be as big as $1 trillion.

Now, interest rates are cooling. And the market is once again grinding toward new highs.

So that massive cash pile is closer than ever to pouring back into the market…

Folks, that “$1 trillion” headline isn’t hyperbole.

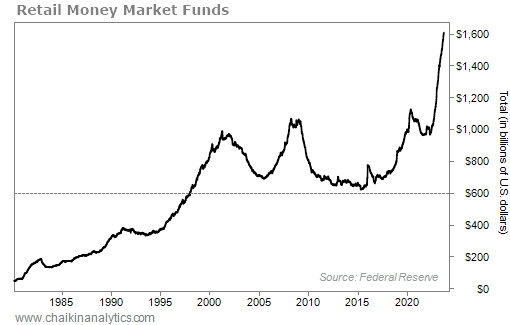

The Federal Reserve tracks the cash on the sidelines of the market at any given time. We can see this number for ourselves. It’s called “retail money market funds.” Take a look…

As an investor, you probably know what “retail money market funds” means…

When you deposit funds into your brokerage account, it goes into a money market account. That’s also where investors park cash they’re either waiting to allocate or that they’ve just pulled from the market.

Now, you’ll notice that the total amount of cash in retail money market funds has grown over the long term. Inflation makes that inevitable.

But it’s still easy to see that something dramatic happened recently. Notice the sharp turn higher on the far-right side of the chart…

The amount of cash on hand recently surged to a record high of around $1.6 trillion.

That’s about $500 billion more than in 2020. And it’s about $1 trillion above the 2015 low.

This chart also tells us something else…

Notice that the total amount of cash on hand ebbs and flows. It grows over time – but not in a straight line.

We’re at a very high point right now. But based on history, we can expect investors to pour money back into stocks some point soon. That makes sense when you think about it…

When investors are fearful, they pile into cash. And when they’re feeling confident, they flood back into the market.

The good news is… the market is riding a significant tailwind right now.

As regular Chaikin PowerFeed readers know, the Federal Reserve is backing off its interest-rate hikes. The central bank will almost certainly leave rates unchanged again in December.

Some analysts even expect the Fed to start cutting rates as early as May.

Folks, this shift is going to create a significant tailwind for stocks. The Fed is taking its foot off the economy’s brake pedal. That will eventually lower the cost of doing business.

So I understand if you’re still uneasy about stocks. Perhaps you’re one of the millions of investors who have too much cash sitting on the sidelines right now.

But the “cash on hand” data is clear…

Investors are overallocated to cash right now. And yet, that extreme won’t last forever.

So it’s time to get out of cash. You don’t want to miss $1 trillion flooding back into stocks.

Good investing,

Vic Lederman