I called it the "everything but one" crash...

At the end of 2021, the markets fell apart. Just about everything collapsed...

The S&P 500 Index eventually plunged 25% from its early January 2022 peak through its October 2022 bottom. And the tech-heavy Nasdaq Composite Index fell a staggering 36% from November 2021 through the end of last year.

It felt like the investment world was ripping apart at the seams.

But one sector defied the odds...

Energy.

The energy sector soared through the first half of last year. In fact, it surged through most of 2021 as well...

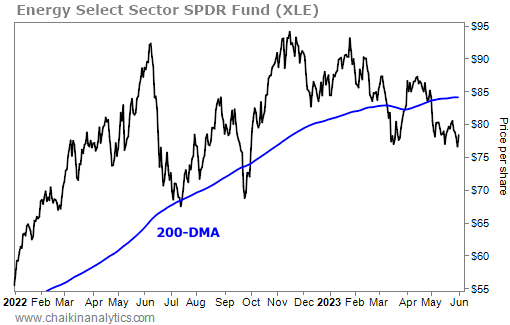

From its bottom in late October 2020 to its peak in November 2022, the Energy Select Sector SPDR Fund (XLE) gained nearly 240%.

Investors dream of returns like that.

But the story is different these days...

As I'll show you, the energy sector is significantly underperforming so far this year. And the Power Gauge is unequivocally clear on this topic...

Now is not the time to try to catch a bottom in energy.

In fact, it's one of the worst sectors in the Power Gauge today...

As almost everything else suffered early last year, XLE thrived. But this once-shining star has clearly faltered...

XLE has lost around 10% of its value since the start of 2023. That's much worse than the S&P 500 Index's roughly 10% gain in that span.

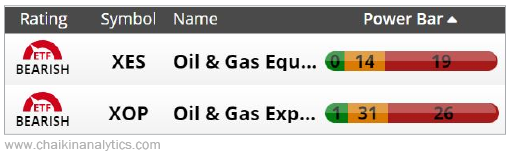

And its Power Bar rating is... terrible. Take a look...

No stock in the exchange-traded fund ("ETF") currently holds a "bullish" or better rating.

The Power Gauge is clear... Investors should avoid the energy sector right now.

Worse still, we can see in the following chart that XLE has clearly broken below its long-term trend line. Take a look...

The blue line on the chart is the 200-day moving average ("DMA"). In other words, each point on that line represents the average of the previous 200 days of XLE's closing price.

Put simply, it's a straightforward way to define a stock's long-term trend.

XLE soared above its long-term trend line in the first half of 2022. But then, it ran into trouble...

You can see that XLE broke below its long-term trend line in July. And it happened again in late September. But in both cases, it quickly bounced back above the line.

Today, things are different...

XLE is clearly trading below its long-term trend line. It's now in a defined downtrend. And barring a reversal, it's telling us to steer clear of the energy sector.

But that's not all...

We can also use the Power Gauge to dig into energy-related subsectors. Similar to XLE, they're some of the worst-rated offerings in the Power Gauge today. Take a look...

The SPDR S&P Oil & Gas Exploration & Production Fund (XOP) only includes one "bullish" holding today. And the SPDR S&P Oil & Gas Equipment & Services Fund (XES) doesn't have any "bullish" holdings.

These Power Bar ratings are terrible. And the Power Gauge is firmly "bearish" on both ETFs.

So our takeaway is clear...

From top to bottom, the energy sector is suffering right now.

Now, it will likely turn around at some point. It's a cyclical industry. And nothing stays down forever.

But don't wait for it...

The energy sector can spend years in a downtrend. Most recently, it spent the majority of 2019 and 2020 trading below its 200-DMA.

So we'll watch this important sector. But for now, we'll fish in other ponds.

Good investing,

Marc Chaikin