When you hear that "the wheels are coming off" in a situation, you likely think figuratively…

After all, most people don't ever expect the wheels to literally come off their cars or trucks.

But as we'll discuss today, one electric-vehicle ("EV") maker recently had to deal with the possibility of that happening. In fact, it's one of many issues working against this company.

And yet, an investment committee that elects new stocks to its index just decided to add the company to its renowned list. So now, more investors will be exposed to the stock.

But as I'll explain, we don't want anything to do with this company. It's clear that the folks who put together this list are doing nothing more than "virtue signaling" today.

Let's dig in…

Folks, the company I'm talking about is Rivian Automotive (RIVN). It makes electric pickup trucks. And as of next Monday, December 19, it will be in the tech-heavy Nasdaq 100 index.

The committee made that change even though Rivian lost $1.7 billion in the third quarter. The company also has a negative 43% return on equity and trades at a growth-type price-to-sales ratio of nearly 23.

I'm being harsh on Rivian. But I have plenty of support for this perspective…

The company is still technically a startup, even though it was founded all the way back in 2009. And 13 years later, it still needs to ramp up its manufacturing facilities.

However, Rivian will have a hard time growing if it doesn't make vehicles that fit into everyone's budgets. The base model of its electric truck comes in at just less than $70,000.

Worse still, the company is in the middle of a recall…

In October, Rivian recalled more than 13,000 vehicles due to a manufacturing error. The company made a production oversight that could literally lead to a wheel falling off.

At first glance, 13,000 vehicles might not seem like a lot. After all, General Motors (GM), Ford Motor (F), and Toyota Motor (TM) all sell millions of vehicles each year.

But then, you find out that Rivian has only delivered about 12,300 vehicles so far this year.

Rivian can't even seem to put its trucks together correctly.

And yet, the investment committee in charge of the Nasdaq 100 somehow missed these issues when it picked this company for its elite index. Or maybe it chose to ignore them.

Fortunately, we don't need to rely on these index managers to help us pick stocks.

That's because we have the Power Gauge on our side. And it's not missing these problems. Take a look…

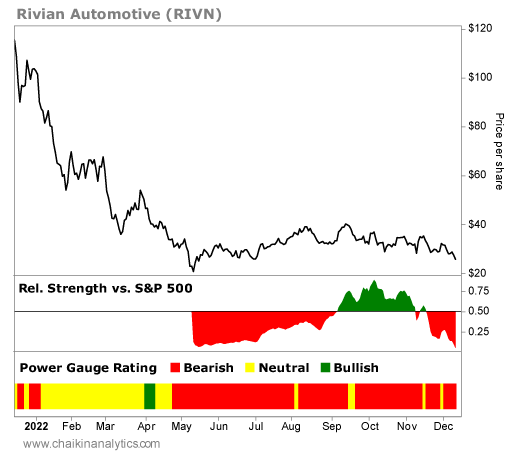

Folks, as you can see, the Power Gauge ranks Rivian as "bearish" overall today. That's the first red flag.

Secondly, the stock's relative strength is deep into negative territory. It's underperforming the benchmark S&P 500 Index in a big way. You can see what I mean in one of the lower panels on the above chart.

You'll also notice that Rivian's stock has been on a one-way trip lower since it went public a little more than a year ago. In fact, it's down around 75% so far this year.

Maybe the investment committee used something else to make its decision. For one thing, Rivian is beating earnings estimates. So we can check that box in favor of the company.

But when we look closer… we see that Rivian is simply losing less money than projected.

It still loses money quarterly. And in 2022, it has reported a loss of $6.85 per share.

Folks, that's horrible! In the first nine months alone, this company lost $5 billion.

Now, Rivian does have $14 billion in cash. That should get it to the end of next year.

However, it could be in trouble if wage and material inflationary pressures persist. The company cited those potential problems in its third-quarter earnings release.

I could go on, but I don't want to waste any more of our time. By now, it should be clear that putting Rivian in the Nasdaq 100 is just a virtue-signaling move by the committee.

Rivian is one of the popular stocks in the EV space. And as of next week, it will be a part of this major tech-focused index.

With this dud in the index, investors will need to rely on the other companies in the coming year. And I wouldn't be surprised if Rivian's stock soon traded in the single digits.

Good investing,

Pete Carmasino