We survived the largest banking crisis in U.S. history earlier this year...

So far, at least.

It might seem like a distant memory. But in the first half of 2023, the failures of Silicon Valley Bank, Signature Bank, and First Republic Bank wiped out nearly $550 billion.

When Silicon Valley Bank and Signature Bank collapsed over a three-day period in March, ripples of fear shot through the economy. Anxious depositors lined up outside nearly every financial institution. And they pulled hundreds of billions of dollars out of U.S. banks.

The panic initially hit regional banks the hardest. Some of these banks' stocks fell almost 50% in a single day.

It didn't take long for the crisis to spread throughout the financial-services industry. Even some of the country's largest institutions fell victim to the panic...

For example, Charles Schwab's (SCHW) depositors and investors didn't need to worry about bankruptcy. And yet, the panic caused the company's stock to plunge more than 30% in a matter of days.

The entire U.S. financial system teetered on the brink of collapse...

You see, the Federal Deposit Insurance Corporation normally only insures depositors up to $250,000. And with billions of dollars in limbo, many folks could've lost everything.

Someone had to stop the panic. Another global financial crisis was imminent.

So on March 12 – a Sunday, by the way – the Federal Reserve stepped in. The central bank said it would "assure banks have the ability to meet the needs of all their depositors."

In other words, it guaranteed all depositors' funds in the failing banks.

Crisis averted.

Seven months later, things have settled down. Depositors aren't panicking anymore, at least.

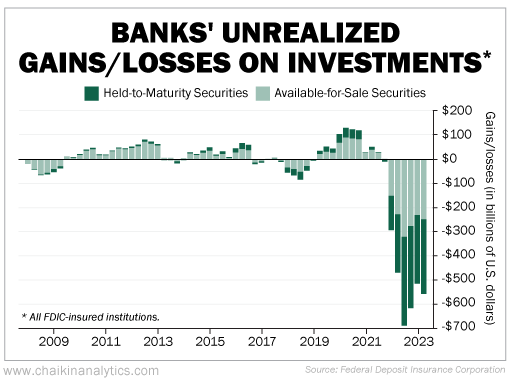

But that doesn't mean it's all roses and rainbows. Just look at the chart below...

As you can see, the unrealized losses on investment securities for U.S. banks in 2022 and 2023 make the financial crisis look like child's play.

Bank of America (BAC) is the second-largest bank in the country. It holds $760 billion in U.S. Treasury securities. But recently, it was sitting on an unrealized loss of $110 billion.

That's more than the entire financial system at any point during 2008 or 2009.

If U.S. consumers catch wind of how big this problem is, it could ignite another bank run...

We're talking about hundreds of billions of dollars in unrealized losses. These losses are keeping banks' balance sheets underwater.

As a result, many banks' "reserve ratios" are off. (The reserve ratio is the portion of cash that a bank needs to hold, rather than lend out or invest. It's how the system makes sure the bank has enough cash on hand to meet customer withdrawals.)

In other words, the banks can't lend.

America's banks are paralyzed. They're still teetering on the edge of collapse today.

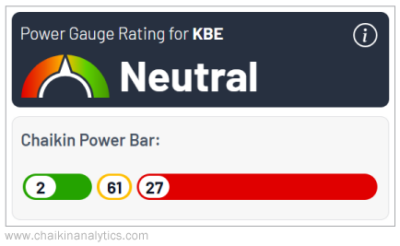

The Power Gauge sees that, too...

The SPDR S&P Bank Fund (KBE) is one of the main ways that we track the banking industry at Chaikin Analytics. This exchange-traded fund ("ETF") holds shares of roughly 90 financial institutions.

Notably, KBE has held a "neutral" or "bearish" rating for most of this year. The Power Gauge also shows that it has firmly underperformed the broad market over that span.

Beyond that, almost none of the stocks in this industry-level ETF hold a "bullish" rating...

Folks, our takeaway today is simple...

The U.S. banking system remains in a rough spot. Be wary of this problem.

Good investing,

Briton Hill