Whether you like it or not, Elon Musk is one of the world’s great visionaries…

Sure, he wasn’t the first person to dream of vehicles that run on electricity rather than gasoline. But with Tesla (TSLA), he’s the one turning the dream into reality…

Over the past decade or so, Musk started making electric cars for the masses. He’s selling them at doable prices. And even if it’s not taking place overnight, change is happening…

Just look around your neighborhood. I bet you’ll see more Teslas than ever before.

For a lot of people, it doesn’t get any better than that. And it’s why they love Musk so much.

Like me, these folks see Musk as a visionary – even after his recent soap opera with Twitter. But unlike me, they take their Musk fandom too far…

You see, for some reason, a lot of Musk’s biggest fans mindlessly love Tesla’s stock as well.

But it doesn’t need to be that way. Whether it’s Tesla or another company…

You can love the story and still hate the stock.

Let me explain…

In short, few things cause more pain to investors than assuming a great story makes for a great stock.

For example, in the late 1990s and early 2000s, the explosive growth of the Internet was a great story. But not every company with “.com” at the end of its name was a great stock.

Do you remember Pets.com? What about eToys.com? Or maybe Webvan.com?

In the end, the dot-com crash wiped out everyone who blindly chased those stocks.

As investors, we need to be able to figure out when a great story makes for a great stock. And fortunately, a simple two-part test can help us…

The first part is profitability.

It might’ve taken several years, but Tesla now passes this test. In the trailing 12 months, the company generated nearly $75 billion in revenue and $3.61 in earnings per share.

I won’t go so far as to say here-and-now profits are required.

After all, losses are normal in the early stages of any business. And cyclical downturns can throw companies that are usually profitable into the red on a temporary basis.

Ultimately, for a company to pass the first part of our test, investors need to at least see a clear and credible path to profitability. And it needs to be within a reasonable time frame.

Tesla now passes this part of the test with flying colors. But we won’t jump in yet.

That’s because the company fails the second part of the test – the price of its stock.

We would be paying too much for Tesla’s stock right now.

Now, Tesla bulls will likely dismiss this part of our test as coming from an old fuddy-duddy who doesn’t understand that great companies are worth higher prices. Don’t go there.

As we talked about yesterday, folks who want better quality should pay higher prices if it makes sense. That’s the case with houses, cars, wine, beef, apparel… and stocks.

Any sticker price can work (or for stocks, valuation ratio)… if the item or company is worth it.

When it comes to stocks, we should make rational projections of future cash flows to decide how much a company is worth.

But this stuff is hard. And it takes a lot of time, especially when it’s more than one stock. Most individual investors can’t do all the work themselves – or they just don’t want to.

That’s where the Power Gauge comes in…

Our one-of-a-kind system does the hard work for us. It analyzes 20 different factors in real time. And in the end, it helps investors like us decide whether a stock is great or not.

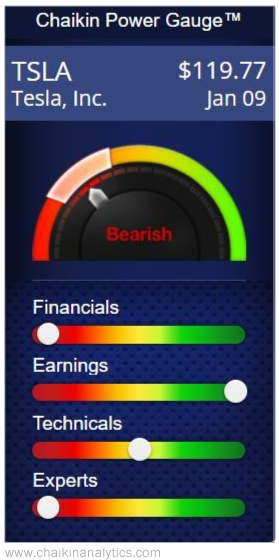

Here’s the current Power Gauge breakdown for Tesla…

In short, the Power Gauge confirms that Tesla’s story itself is great…

The Earnings category receives a “very bullish” ranking. And within the Financials category, the factor for the company’s long-term debt to equity ranks “bullish” as well.

But when we look at the rest of the Power Gauge, we can see that the stock isn’t so great…

The Technicals category ranks as “neutral” today. And within that category, the Chaikin Money Flow indicator is “bearish.” That means the big institutional investors are selling.

That’s concerning. And so is Tesla’s “very bearish” grade in the Experts category.

In the end, our takeaway is clear…

No matter how great Tesla’s story is, it isn’t worth the stock’s current sticker price. The Power Gauge helped us see that. And its “bearish” overall ranking is all the proof we need.

Remember, you can love the story and still hate the stock. That’s the case with Tesla today.

Good investing,

Marc Gerstein