With interest rates surging higher, many readers are asking us the same question…

“What about bank stocks?”

After all, banks make money by lending it out. And in theory, higher interest rates mean better returns on that money.

That’s the theory, at least. So far this year, the reality is much different…

Like many investments, bank stocks have fallen throughout 2022. The SPDR S&P Bank Fund (KBE), which tracks the space, is down about 21% since mid-January.

That raises some interesting questions…

If we’re now in a high-rate environment, should we expect bank stocks to rebound?

What about the Federal Reserve’s strategy? Still hoping to tame inflation, the central bank just announced yet another 75-basis-point rate hike yesterday afternoon.

Let’s examine this situation through the lens of the Power Gauge. You’ll find that bank stocks are worth considering today. But don’t take your eyes off the exits…

In terms of the Power Bar ratio, banking ranks fourth out of 68 industries right now. Remember, as we discussed last Friday, that’s the ratio between stocks with “bullish” or better Power Gauge ratings (159 among banks) and those ranked “bearish” or worse (six).

This positive Power Bar setup helps KBE earn a “bullish” Power Gauge ranking today.

So with just a glance, we know that bank stocks are worth considering. In fact, the banking industry is one of the better-performing areas of the market right now…

I noted earlier that KBE is down about 21% since mid-January. But since late September, the exchange-traded fund (“ETF”) has climbed around 7%. And the Power Gauge sees more opportunity ahead.

However, before investing in banks, we need to consider an important factor…

I’m talking about the “yield curve.” In short, that’s the difference between short- and long-term rates.

The Fed controls the federal funds rate (the so-called “overnight” lending rate). But it doesn’t dictate the yield curve. The market does. And the yield curve is based on investors’ expectations…

If investors expect rates to keep rising because of inflation, strong economic growth, or both… longer-term rates will rise. And in response, the spread between short- and long-term rates will widen.

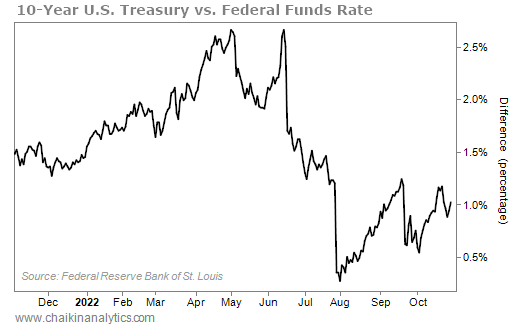

So with that in mind, check out the following chart. It shows the 10-year U.S. Treasury note (long-term rate) minus the federal funds rate (short-term rate) over the past year…

Notice that the numbers are all above zero.

When business expands, investors expect more borrowing in the future. That usually leads to higher interest rates. So in most cases, this indicator remains above zero.

That’s the case today, which is good. It means rate hikes are helping bank margins.

But notice that the measurement has been erratic over the past year…

All trend lines tend to zig and zag. However, in this case, zero is a significant number. And as you can see, the line got uncomfortably close to zero back in late July and early August.

When that happens, it’s concerning. It makes things difficult for bank executives…

If you own bank stocks, you should hope for the spread to move more comfortably above zero in the weeks ahead. If it doesn’t, banks might start adding to their reserves in anticipation of a weaker economy and more loans going bad.

When banks add money to their reserves, it cuts into their earnings. And of course, dead-loan write-offs that exceed reserves also hurt banks.

Wall Street really hates when that happens. So it punishes bank stocks – sometimes badly.

Worst of all, average investors like us usually don’t see this shift coming.

That’s why it makes sense to spread our risk across many investments in the space. We can do that by owning an ETF like KBE, rather than individual bank stocks.

Today, all systems are a “go” for KBE. But we need to keep our eye on it…

The Power Gauge will help us watch KBE closely. If its Power Bar ratio or another proprietary metric called the ETF Technical Rank turn “neutral” in the days ahead, we’ll assume that investors are getting antsy.

If that happens, we won’t argue with the market. We’ll just head for the exits.

Good investing,

Marc Gerstein