Folks, I never invest directly in small-cap biotech stocks… And neither should you.

The stories involving these stocks often read like horror novels…

Failed drug therapies, fraud, and even death are a few things that come to mind. And when any of this bad news happens… the stocks get crushed.

But the thing is, these events are all hard to predict. That’s why I stay away from these types of stocks.

For me, it’s all about the risk-to-reward ratio. If I don’t see an asymmetric risk setup, I’ll look elsewhere.

Specifically, I look for trades in which the potential reward is at least 2 times the downside risk.

And since the uncertainty with small-cap biotech stocks is much higher, I expect an even better risk-to-reward ratio. The potential reward needs to be 3 times – or even 4 times, in some cases.

These types of stocks are popular with investors right now. After selling off for much of the past year, they’re currently soaring. Almost everybody wants to get in on this hot trend.

But unfortunately, many investors will fall into a classic trap.

Today, we’ll take a closer look at this trap. And I’ll detail what you can do to avoid it…

The biggest issue is company size…

Many biotech firms are small. And I mean really small.

We’re talking about “penny stocks” in many cases. Dozens of these companies don’t even have any sales. And if they do have any sales, their market caps can be 20, 30, or even 50 times sales.

That means they’re way too expensive.

I get nervous even writing about these stocks. So don’t think for a second that I’ll share any names. Just a mention to a large audience can send the share price on a roller-coaster ride.

On the flip side, larger biotech companies can provide great opportunities for investors…

For example, last Thursday, I pointed out a developing opportunity in large-cap biotech company Biogen (BIIB).

Biogen’s chart is starting to look attractive from a technical basis. And the company has a large market cap of $31 billion and sales of $10 billion.

Do the math. That means the stock currently trades at about 3 times sales.

That’s within the realm of reason.

And fortunately, there’s another easy way to play the new, developing trend higher in biotech. You can simply use an exchange-traded fund (“ETF”)…

ETFs are a terrific way to gain exposure to this sector and not lose any sleep at night.

One ETF that came up in my research has more than $7 billion invested in it.

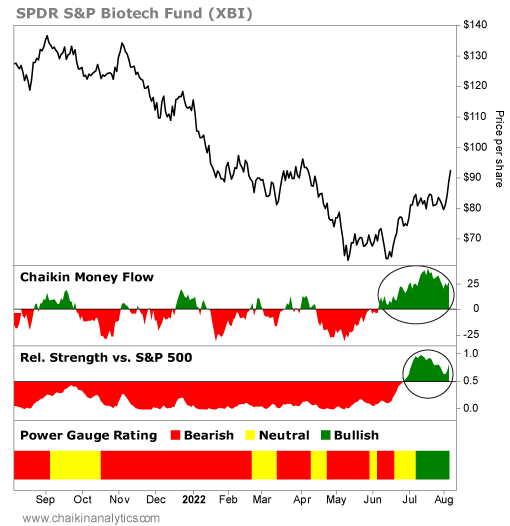

It’s the SPDR S&P Biotech Fund (XBI). Just look at the chart…

Everything is setting up nicely…

Like Biogen, XBI has a “bullish” setup on a technical basis. You can see what I mean with the relative strength indicator in the above chart. Notice the shift to green in July.

A stop loss at $75 per share means the downside risk would be roughly 19% from XBI’s current share price ($92.30). So the upside reward would need to be about 38% to get to my 2-to-1 risk-to-reward ratio.

That would put the target for the ETF at about $127 per share. That’s about where it traded last November.

Better still, this ETF earns a “bullish” overall rating from the Power Gauge today. And the Chaikin Money Flow indicator is firmly in the green zone, too. That tells us the “smart money” is piling into this opportunity right now.

An ETF like XBI can help you diversify in a risky sector like biotech. It gives you meaningful exposure to the space. And when biotech stocks work out, they can be very profitable.

Look for signs of opportunity, use our process, and stay disciplined by not taking too much risk. In the biotech space today, you can do that by avoiding the small-cap trap.

Good investing,

Pete Carmasino