When something happens in life, plenty of folks ask, “Why?”…

That’s a good trait. It’s important to question things in many cases…

You can learn a lot more about a topic with that one simple question. You can clarify directions and eliminate confusion. You can kick-start creativity and get ideas flowing.

But when it comes to technical analysis… the “why” isn’t as important as something else.

You see, folks often wait to understand the “why” behind a stock’s move. And by the time they act, they’ve missed the opportunity. Or worse, they’re on the wrong side of the trade.

We’re seeing this situation play out in the market right now…

Many investors are asking, “Why do tech stocks fall when interest rates rise?“

Today, we’ll look at how waiting for a “why” can hurt investors. And importantly, we’ll examine how the market signals “when” long before that happens…

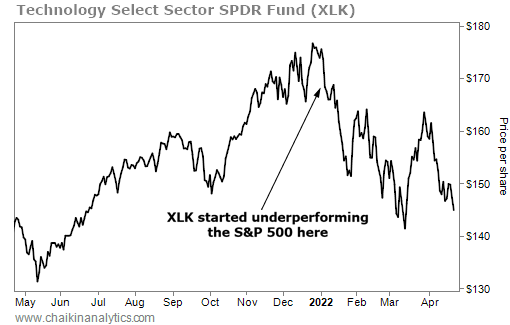

We’ll start by looking at the Technology Select Sector SPDR Fund (XLK)…

As its name implies, it’s an exchange-traded fund (“ETF”) that tracks the technology sector. Its biggest holdings are Apple (AAPL) and Microsoft (MSFT), which combine to make up more than 40% of the ETF. It also holds companies like Visa (V), Nvidia (NVDA), and Adobe (ADBE).

Look at what happened to XLK at the start of this year…

The ETF started falling in January. It’s down about 19% from its peak. And as we’ve noted on the chart, XLK began underperforming the broad market around that time as well.

In other words, that was “when”… Easy enough.

The “why” involves higher interest rates. Folks started fearing that the Federal Reserve would raise the benchmark rate to fight inflation. And that’s bad for tech stocks because higher rates make debt-fueled growth – common in these companies – more expensive.

But here’s the kicker… The Fed didn’t actually raise the benchmark rate until March.

That part trips up many investors…

They see big changes in the momentum of a stock or ETF and think something like, “That’s weird.” But instead of digging deeper, they wait for the “why” to hit the mainstream.

In many cases, it’s too late at that point.

The beauty of technical analysis is that we start with a base assumption…

The market is always processing every available piece of information. That’s especially true these days, where everything happens in an instant. We’re living in a high-speed world.

And we see everything play out in the price action of listed assets – like stocks and ETFs.

When we combine that with historical data, we end up with a very powerful tool. Simply put, we can get special insights into critical price changes that other investors ignore.

That’s a big part of how the Power Gauge works. It studies all of the data available behind 20 key factors. And it uses that data to determine “when” for each stock in its universe.

In our example, you didn’t need to be a student of the Fed. You didn’t need to perfectly understand the “why” behind rising rates and falling tech-stock prices. Heck, interest rates across the board started moving two months before the Fed officially announced its plans.

You just needed to recognize the market signaling “when” long before it put a bow on the “why” behind the move.

Investors who had technical analysis on their side saw the trend changing in early January. They knew it was significant. And they were able to make a move to capitalize.

On the other hand, investors who waited for it all to make sense – the ones who spent precious time asking “why?” – got burned.

If you wait for that answer, you’ll eventually find out. But unfortunately, it could cost you.

Instead, you’d be much better off reacting when a trend starts to change.

Good investing,

Pete Carmasino