Netflix (NFLX) shareholders breathed a sigh of relief last Wednesday…

The stock jumped more than 7% that day. The big move higher happened after the video-streaming giant said it lost only 970,000 subscribers in the second quarter.

Now, in most cases, losing almost 1 million subscribers in a quarter would set off alarm bells. But in Netflix’s case, investors saw it as good news…

You see, Netflix previously expected to lose 2 million subscribers that quarter. And even better, management now expects to gain 1 million subscribers in the third quarter.

That’s a big improvement from three months ago…

On April 20, Netflix’s stock plunged 35% after the company said it lost 200,000 subscribers. That’s because investors expected a gain of 2.5 million subscribers.

So now, you might think all is well. It seems like the crisis is over for Netflix.

If only it were that simple…

Folks who play Wall Street’s “guidance game” should be happy. The company beat the latest set of expectations. So with that short-term mindset, things look good again.

The guidance game does matter. We see it often enough anecdotally.

And there’s legitimate research behind it as well. After all, two of our Power Gauge system’s 20 factors (earnings surprise and estimate trend) are products of the guidance game.

But be careful. Investing involves a lot more than just playing the guidance game…

That’s why the other 18 Power Gauge factors are different. And folks who use their own judgment to pick stocks know how limited the guidance game can be.

Today, I want to address one critical, non-guidance-game factor in the Power Gauge…

I’m talking about the valuation ratio of “price to sales (P/S) including debt.” It’s one of my favorite Power Gauge factors…

Unlike other valuation ratios, this one eliminates the need to consider fancy ways companies might account for expenses. It also allows us to evaluate money-losing companies and businesses with minimal profitability.

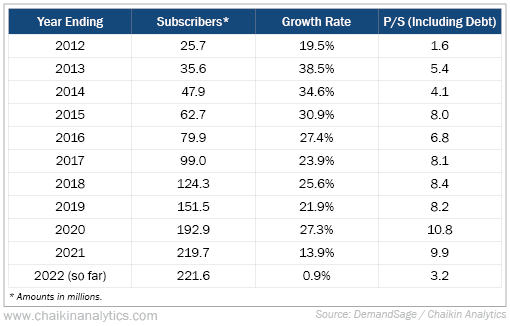

With that in mind, let’s next match the trend in the P/S ratio with Netflix’s subscriber count. For each year in the chart below, ask yourself…

Is Netflix’s P/S ratio reasonable based on what I might expect for future subscriber growth?

Don’t torture yourself trying to be precise.

We invest based on the future. We can’t know for sure what will happen. So therefore, we need to follow the classic maxim, “It’s better to be vaguely right than precisely wrong.”

In the spirit of this exercise, you can cheat a little bit. Assume the most recent growth rate represents the probable future. So with that said, here are the numbers…

I bet most of you could tolerate Netflix’s low 2012 P/S ratio. And you’d probably say “maybe” for 2013 through 2016. The P/S ratios are higher, but that came with fabulous growth.

Now, move down to 2017 through 2021. You’ll likely feel less comfortable with these numbers…

Again, don’t obsess over precision. Just recognize the worsening connection between growth and value.

Netflix’s valuations have been climbing, but the company’s growth has been slowing.

That’s a problem.

And things look even more interesting so far this year…

Subscriber growth has vanished. It’s only at 0.86%. But at the same time, the company’s P/S ratio is way down. It looks like 2012 again at roughly 3.2.

So in other words…

We’re halfway to Netflix’s glory days. But until growth returns, it’s still just halfway.

Maybe Netflix will revolutionize its business with new advertising-supported service tiers. We’ll all need to wait and see.

But for now, it’s best to steer clear of this uncertain situation…

The Power Gauge just flipped to “bearish” on Netflix this week. And as we’ve learned, focusing on stocks with clear “bullish” outlooks is the best way to succeed as an investor.

For me, in 2022, I’d rather have the full Netflix from 2012 than half of it.

Good investing,

Marc Gerstein