When inflation is this high, a recession always happens…

It happened in the early 1980s. And it happened every other time inflation rose above 5%.

The reason is the Federal Reserve. It needs to raise interest rates in response. That’s the central bank’s primary tool to fight inflation when it gets too high.

Specifically, in times like this, the Fed raises the “federal funds rate.” That’s the overnight lending rate between banks. And importantly, it influences all other interest rates.

The thing is, it’s not pretty when the Fed goes to work. When inflation is in the 8% range like today, the Fed needs to hike rates higher. And that’s painful for stocks…

In fact, as our company’s founder Marc Chaikin noted yesterday, Fed Chair Jerome Powell even acknowledged that these actions will create “some pain” for Americans.

Fighting inflation will bring some pain. But not fighting it would bring far greater pain.

Now, the question is… how long will the pain last?

Let’s use 1981 as our guide since we’re starting at a similar inflation level today…

Back then, it took 16 months to finally escape the recession. And with that time frame in mind, we can figure out how long our current recession will likely last.

Let me explain…

Interest rates are going higher. And we can’t do much about it except manage our risk.

We’ll start by looking at what everything meant for folks in the early 1980s…

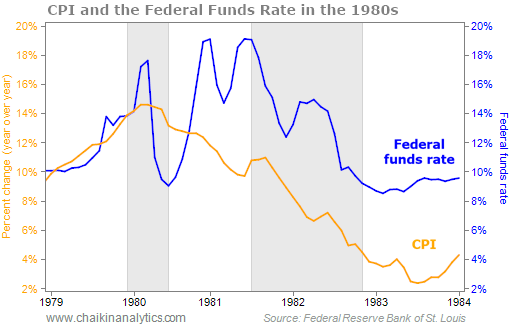

The gray boxes show the two recessions. The blue line is the federal funds rate. And the orange line is the year-over-year percentage change for the Consumer Price Index (“CPI”)…

Notice how the Fed cranked up the federal funds rate as inflation climbed heading into 1980. Then, it loosened this rate a bit in response to the first recessionary period.

But when inflation remained stubbornly high, the Fed went to work. And then, after the second recessionary period, it kept the federal funds rate above inflation for years.

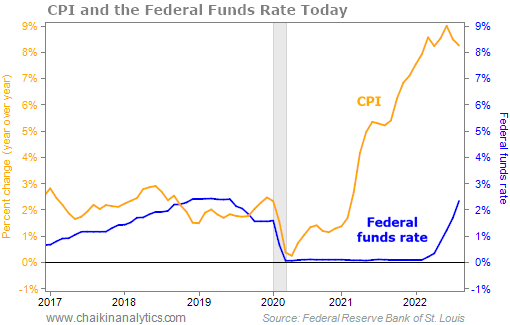

Now, let’s look at the same two data points today…

As you can see, the federal funds rate and inflation are far apart. It’s a large gap to close. That won’t happen overnight. And that’s critical…

Inflation hasn’t been at this level since the early 1980s. Back then, the federal funds rate needed to get above inflation – and stay there – to be effective.

Inflation is always the same. It’s too many dollars chasing too few goods.

And in the post-COVID-19 economy, we’re facing a double whammy. Goods became dangerously scarce due to the lockdowns. And in response, inflation ran even higher.

Now, the Fed must raise the federal funds rate. And since inflation went so high, the federal funds rate needs to go even higher. It will need to go higher than the inflation level.

The Fed hopes demand can slow enough to push inflation down. Then, it won’t need to raise the federal funds rate too high. Still, it could be at 4% by the end of 2022. (It’s at a range of 2.25% to 2.5% today.)

That’s like a “tightrope act” – which is what my colleague Karina Kovalcik called it in April.

You see, recessions stop rates from going higher. So we’re in a “no pain, no gain” situation.

I’m not saying we’ll see bread lines and food stamps for everyone. Not even close.

Folks, it simply means you need to mind your money and take less risk. And to do that, you need to know which sectors do the worst when rates get too high.

Here’s the bottom line…

We find ourselves in a not-so-different situation than in the early 1980s. But even if history rhymes, it doesn’t always repeat. So we can’t expect the exact same outcome this time.

Did the CPI peak in June at 9.1%? I can’t know that for sure. No one can.

But if so – and if history is a good guide – it looks like the pain of higher rates could last at least another 12 to 14 months. That’s the timeline we’re looking at today.

So to protect yourself in the months ahead, avoid heavy exposure to sectors that don’t do well when rates rise. By that, I mean sectors like technology and consumer discretionary.

As Marc noted yesterday, real estate is another sector to avoid. And don’t forget bonds. As rates rise, their prices fall.

Pain might be inevitable. But looking back at history and following the current trends can help you avoid too much of it.

We can learn from the past. And right now, it’s sending us a clear message…

Be careful with your investment money today.

Good investing,

Pete Carmasino