I don’t need to keep harping on the market’s struggles…

Even with its most recent bounce, the S&P 500 Index is still down more than 16% in 2022.

And the tech-heavy Nasdaq Composite Index remains in full-on crash territory. It’s down roughly 30% from its November 2021 peak.

With stocks down, it means less money for most investors. But it’s even worse…

Prices of nearly all household items are skyrocketing.

As a result, the average American consumer is faced with a big problem…

They have less money to spend on items that are more expensive than ever before.

Needless to say, it’s hard to paint a pretty picture of how things look right now. And if you’re like most people, you don’t have much confidence in our economic outlook.

In fact, one of the leading indicators used to predict investors’ feelings shows that things haven’t been this bad in decades. That’s tough to hear.

But you might be surprised to learn…

That likely means we’re nearing the end of this downturn.

Let me explain…

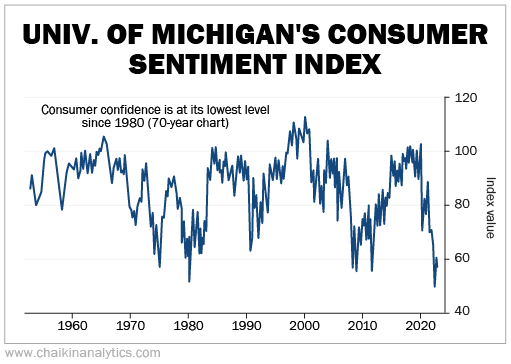

Folks, the leading indicator I’m talking about is the University of Michigan’s Consumer Sentiment Index.

Put simply, the Consumer Sentiment Index tells us how confident the average Joe is in the economy at any given time. It’s sometimes referred to as “consumer confidence.”

The bottom line is this…

Consumer spending is the bedrock of the economy. And confident consumers spend money.

So rising levels of confidence drive bull markets. And on the flip side, falling levels of confidence drive bear markets.

The bad news is… people are feeling pretty down on their luck these days.

That’s obvious. After all, we’re in a bear market.

But fortunately, there’s a silver lining to our current situation…

Historically, big extremes in consumer sentiment are a major buying opportunity.

Take a look at the chart below…

If you’re feeling nervous about the economy, you clearly aren’t alone.

As you can see, people haven’t felt this bad in more than 40 years.

But here’s the good news again… History tells us we can only go up from here.

Consumer confidence hasn’t been this low since 1980. And of course, if you’ve followed the markets at all since then, you know… that’s when a 40-year-long bull market was born.

The 1970s were full of struggles for the American consumer. The decade featured volatile markets, soaring prices of household items, and shortages. Many people lost their savings.

If you think about it, that’s not too different from today.

Now, here’s a key part of this message you can’t afford to miss…

Today’s extreme isn’t flashing the big buy signal yet. We’re still not completely out of the woods. Inflation remains higher than normal. And volatility continues to plague the market.

I’m simply saying that the worst is likely behind us. That means the end is in sight.

But the truth is, even though consumer confidence bottomed in 1980, the new bull market didn’t start immediately. The 40-year-long bull market wasn’t born until 1982.

The same thing happened in 2008…

Consumer confidence bottomed in the summer of 2008. But the markets didn’t bottom until the first few months of 2009.

That means now, more than ever, we need to watch the markets closely for opportunities. And we need to deploy our capital in the right places.

Even if it feels like everything is going wrong in the market, you can still find pockets of opportunity. That’s the beauty of investing.

Fortunately, the Power Gauge helps us identify the best sectors at any given time. So we’ll know exactly where the big money is flowing once the markets start recovering.

But for now, our path forward is simple…

Be patient. Get confident about the coming recovery. And trust the data.

Good investing,

Marc Chaikin