Believe it or not, signs of economic slowing were once viewed as bad news for stocks.

But “Dr. Doom” changed that with one legendary prediction on August 17, 1982…

You see, former Salomon Brothers Chief Economist Henry Kaufman – known by the nickname “Dr. Doom” – had previously projected that deficit spending and a strong economy would push already-high interest rates in the U.S. even higher.

But then, on August 17, 1982, he reversed course… That day, Kaufman forecasted that rates would instead fall due to “financial blockages and tough economic competition.”

Dr. Doom’s reversal turned the financial markets upside down…

After that, bad economic news became bullish for stocks… A bad economy meant less demand for money, and less demand for money meant folks needed to pay less to borrow it (i.e., lower interest rates).

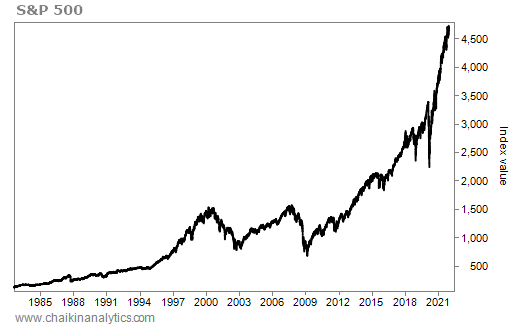

In response to Dr. Doom’s reversal, the S&P 500 Index jumped 4.8% on August 17, 1982. That was the benchmark index’s biggest one-day percentage gain in decades.

And despite some small bumps along the way, the S&P 500 has experienced an incredible ride higher for nearly 40 years since Dr. Doom’s prediction. Take a look…

Importantly, this hasn’t just been a bull market… It has been a bull market driven primarily by lower interest rates.

The following chart shows exactly what I mean. It’s the interest rate (or “yield”) on the 10-year U.S. Treasury note since August 17, 1982…

As you can see, the 10-year yield has trended lower since the 1980s. That caused bond prices, which move inversely to yields, to rise over that span.

Don’t look at these charts for perfect trends, though. Just keep the big picture in mind… Expectations of lower interest rates powered a bull market of nearly 40 years.

But we’re in a sticky situation today… Interest rates are near zero. And as a result, the post-1982 experience won’t repeat. It can’t.

That means we’re now at another major reversal in the financial markets…

Going forward, equity investors will need to say goodbye to the Dr. Doom era and live with interest rates that stay flat (the best-case scenario) or rise. It’s a brand-new ballgame.

But that doesn’t mean stocks are dead. It just means bulls must think differently…

In this new ballgame, profits will have to drive stocks upward instead of falling rates. Stated mathematically, it’s about the price-to-earnings (P/E) ratio multiplied by earnings.

You see, lower interest rates cause P/E ratios to rise. So the Dr. Doom era depended on falling interest rates to push P/E ratios and stock prices higher.

In other words, during the Dr. Doom era, you could get things wrong in your analysis of a company. The market – “Uncle Fed” – was often happy to cover up your mistakes.

Now, the new ballgame will be about rising earnings. Here’s what it means for your decision-making process…

Earnings are based primarily on company-specific factors. Moving forward, the Fed won’t be there to bail you out if you make mistakes.

We’re now in what’s called a “stock picker’s market.”

Don’t let that phrase intimidate you. It’s what most individual investors usually try to do…

The end of the Dr. Doom era means we’re better positioned to succeed as individuals without feeling stomped on by institutions riding the waves of lower rates and the resulting P/E expansion.

And as we head into 2022, you can approach this new ballgame with in-depth security analysis. Or you can simply do what I do… Trust the “Power Gauge” to do the grunt work.

Good investing,

Marc Gerstein

Editor’s note: Our proprietary “Power Gauge” system can help you analyze thousands of stocks at any time with just a few clicks of your mouse… Even better, it can guide you to the best places to put your money to work in the days, weeks, and months ahead.

Chaikin Analytics founder Marc Chaikin recently put together a special presentation in which he walks through how to use the Power Gauge – and also makes the biggest prediction of his five-decade career. You’ll get a free recommendation just for tuning in. Learn more here.