These days, debt levels are rising alongside higher interest rates and persistent inflation…

As I said yesterday, I call this dangerous mixture the “trinity of trouble.”

Delinquencies are creeping higher, too. They’re not at record highs by any stretch. But some companies are already feeling the pressure more directly than others…

In fact, one group is particularly sensitive to this problem – credit-card companies.

More specifically, we’ll focus on Visa (V) and Mastercard (MA) today. They’re the heavy hitters in the industry, after all.

Both companies went public leading up to the worst part of the 2008 crisis. And importantly, both benefited from the Federal Reserve’s low-interest-rate policies and a hot economy for the past 14 years.

These companies produce revenue from the interest earned on consumer balances. In this case, the consumers’ liability is the credit-card company’s asset – at least in good times.

Before we dig in, here are a few “what if” situations that could occur…

- What if the Consumer Financial Protection Bureau were to put a limit on credit-card rates?

- What if people started to use more debt to try to keep up with inflation and then large numbers of folks couldn’t pay their bills?

- What if interest rates rise to a level at which consumers can’t pay their minimum monthly payments?

These are all worst-case scenarios for credit-card companies like Visa and Mastercard. And yet, at the same time, they’re not entirely unreasonable.

Plus, as you’ll recall from yesterday, more folks are already struggling to pay their bills than earlier this year.

So let’s figure out what it all could mean for these two big credit-card companies moving forward…

First, let’s quickly review the interest-rate landscape…

Rates are up and heading higher today. And that trend is unlikely to change…

After all, uncollateralized debt – like a credit card – tends to have the highest interest rates. And credit-card companies are still playing catch up with the new rates and risk structure.

Also, the amount of credit outstanding is growing significantly. The Fed’s latest report shows that consumer credit increased at a seasonally adjusted annual rate of 8.3% in August.

So with that in mind, we’ll next look at how rising rates are influencing the biggest players in the credit-card space. It’s so clear on the charts below that it’s shocking…

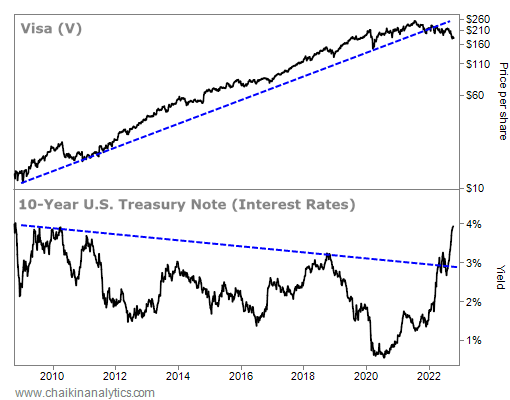

We’ll begin with Visa. The following chart shows its share price since the 2008 crisis (top panel) alongside the 10-year U.S. Treasury note’s yield (bottom panel). Take a look…

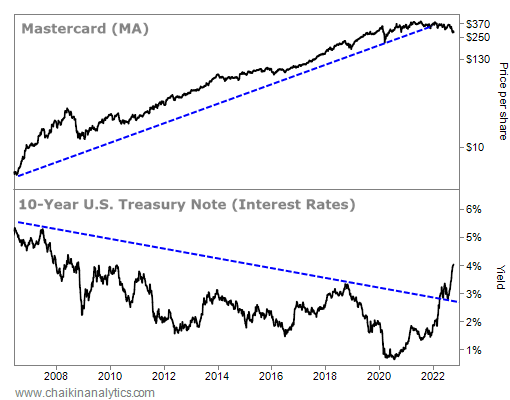

It’s not just Visa, either. Mastercard is suffering the same fate. Take a look…

You don’t need to be a charting expert to see what happened here…

Rates fell for more than a decade. But now, they’re moving higher at a record pace.

They broke through their long-term trend (the dashed line) to the upside. And at the same time, the stocks of Visa and Mastercard broke through their long-term trends to the downside.

My point is simple…

Both Visa and Mastercard are weak stocks in a weak industry right now. And they’re facing major macroeconomic headwinds…

Debt levels, interest rates, and inflation are all rising at the same time. That’s the trinity of trouble.

Not surprisingly, Visa and Mastercard both earn a “neutral” rating from the Power Gauge today. And based on the current setup, I wouldn’t be surprised if they turned “bearish.”

As investors, it’s important to avoid these types of stocks. They won’t do any favors for your portfolio.

Sure, more consumers are spending more on their credit cards. That’s a good thing for these companies – to a point…

Keep an eye on the earnings reports from Visa and Mastercard later this month. See what the companies say about their delinquency levels. It’s a bad sign if they’re rising.

We’re at the end of the “easy money” era. And the end of low-risk lending for credit-card companies means Visa and Mastercard are likely facing much tougher times ahead.

Good investing,

Pete Carmasino