The market rejoiced when the latest inflation update came out last week…

As my colleague Karina Kovalcik noted yesterday, the Consumer Price Index (“CPI”) showed a 7.7% year-over-year gain in October. And stocks ripped higher in response.

The CPI result was a bit lower than the projected 7.9% increase. And notably, it was also below the inflation gauge’s 8.2% reading in September and roughly 9% peak in June.

In short, the Federal Reserve’s inflation-fighting strategy seems to be working.

That shouldn’t surprise regular Chaikin PowerFeed readers, though…

We covered the Fed’s strategy a little more than a month ago. On October 11, I wrote…

I realize that what I’m about to say is hard to accept. But right now…

The Fed is getting it right.

I’m serious. And we have data to support that claim.

Long ago, fighting inflation might’ve seemed impossible…

We didn’t yet fully understand the way money supply, interest rates, and inflation related to one another. So the Fed of yesteryear was trying something new and unproven.

That’s no longer the case…

You see, the central bank now has a time-tested playbook. And the playbook is working.

The good news is that the Fed broke the CPI’s upward momentum. However, the war against inflation isn’t over yet.

As you’ll see today, another big battle lies ahead…

I explained last month that we’re dealing with “demand-pull inflation.” That just means too much money is chasing an inadequate supply of goods and services.

This time, the excess supply of money came from all the stimulus in the wake of the COVID-19 pandemic. And with shortages of all sorts of goods, that money chased limited supplies.

The Fed (or anyone) can’t just snap its fingers and fix the problem. It can’t just create more goods and services to match the excess supply of money.

So the Fed is doing the only thing it can…

It’s raising interest rates to suppress the money supply and demand for goods and services.

Unfortunately, demand suppression means companies generate less revenue. They try to protect profits by cutting costs – often through layoffs. That’s the essence of a recession.

We don’t know how much more economic pain will occur before the money supply and economic activity realign. But we can turn to history for some critical clues…

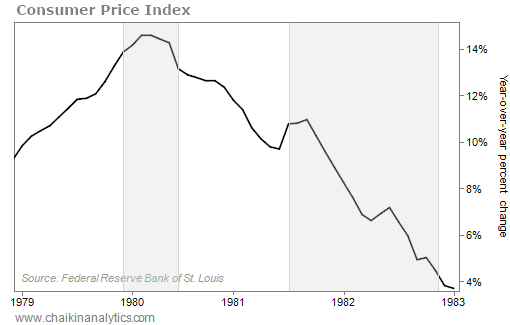

Specifically, I’m talking about the early 1980s. That’s the last time inflation caused this much trouble in the U.S. And here’s how things played out with the CPI back then…

The shaded areas on the chart indicate recessions.

As you can see, we experienced a six-month recession in early 1980. Then, we endured a longer recession well after the Fed won the first round of its fight against inflation.

As mid-1982 approached, investors still hated inflation rates above 5%. And even worse, many folks feared that inflation would soar back up to double-digit percentages.

Then, on August 17, 1982, Salomon Brothers Chief Economist Henry Kaufman – nicknamed “Dr. Doom” for his harsh prognostications – told the world that disinflation was real.

Many folks didn’t believe it at first. But before long, enough investors bought into the idea to launch stocks into a mega-rally that lasted for the better part of 40 years.

That rally got started near the end of the longer recession in the early 1980s. And it was a little less than two and a half years after inflation started to soften.

In other words… investors remained wary for a very long time.

This is where the 1980s-era precedent gets murky…

These days, we’re seeing bursts of hope and caution. The markets swing wildly on every little bit of news. And it’s hard to tell how much is being driven by investor sentiment alone.

“FOMO” – the fear of missing out – is much more prominent today than in the 1980s, too. With information traveling so rapidly, no one wants to be late to the recovery.

There’s another new twist these days…

The markets didn’t have as many institutionally unleashed “robots” back then.

The company I worked for in the 1980s had mandatory rounding conventions for estimates. My manager would’ve yelled at me if I estimated $1.04 per share instead of $1.05.

It’s much different today. If a company reports $1.04 per share in earnings versus a Wall Street consensus estimate of $1.05, the stock might fall off a cliff.

A similar result could happen if the CPI isn’t “perfect” in next month’s update. For example, imagine what might happen if it comes in at 7.8% in November versus a 7.6% estimate.

Sure, the world has changed. But the thing is…

Sentiment still plays a major role. That’s true even if it’s robot sentiment.

And history tells us that investors can stay skittish – even when the worst is over…

That was the case with human investors in the 1980s. It’s still the case with human investors today. And I bet that it’s true for all the robot investors as well.

Keep that in mind. Don’t blindly rush back into stocks after one good inflation report.

Good investing,

Marc Gerstein