Just before the 1929 market crash, John F. Kennedy’s father stopped to get his shoes cleaned…

But the enthusiastic, young shoeshine boy wanted to offer something more – stock tips.

That’s all Joe Kennedy needed to hear. In his mind, nothing could indicate a market top better than unsolicited stock advice from a shoeshine boy.

The legend says Joe immediately got out of the market. Then, he “shorted” it and got filthy rich.

True or not, this story is an investor favorite for good reason. It sends an important warning about market manias.

Put simply… a top is near when the proverbial “shoeshine boys” get in on the action.

That’s important to remember right now…

You see, whether it was intended or not, global investing giant VanEck created a modern-day shoeshine boy investment. And as you’ll see, it called the most recent market top.

Let’s take a closer look…

The VanEck Social Sentiment Fund (BUZZ) launched in March 2021.

The idea behind the exchange-traded fund (“ETF”) is easy to understand. It invests in 75 mid- to large-cap stocks based on the amount of hype they’re getting on social media. And it’s based on the Buzz NextGen AI U.S. Sentiment Leaders Index…

To be considered for the index, companies need a market cap of at least $5 billion. They also need consistent and diverse mentions on social media over the previous year.

From there, any stocks that meet the criteria are ranked. The top 75 go into the index.

The idea is to use crowd sentiment to find good companies. Essentially, it becomes a momentum index.

In short, the index and related ETF are the collective shoeshine boy…

The index’s creators use artificial-intelligence (“AI”) tools to track websites like Twitter and StockTwits. These AI bots decipher between good and bad phrases relating to stocks.

But it’s an interesting choice, to say the least…

On Twitter, 50% of users don’t have a college degree. I’m willing to bet that a much higher percentage don’t even know investing basics. Plus, 92% of posts come from 10% of users.

So there you go… That’s your BUZZ Investment Committee.

It’s no surprise that the ETF is effectively a “meme stock” fund. Its largest initial holdings included Twitter (TWTR), DraftKings (DKNG), Meta Platforms (FB), and Tesla (TSLA).

Investors couldn’t get enough when BUZZ launched in March 2021. Its assets quickly skyrocketed to more than $500 million.

But the good times didn’t last long… Today, the ETF only boasts about $75 million in assets.

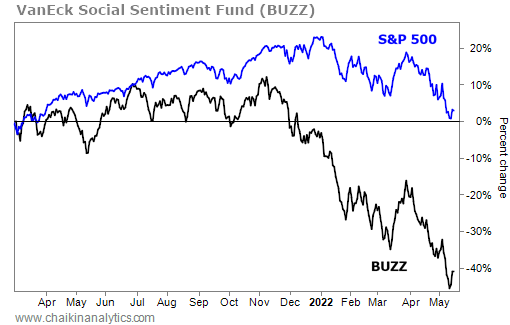

And more importantly, this proverbial shoeshine boy called the latest market top. Look at how BUZZ sputtered out shortly before the broad market took a nose dive…

The ETF is down roughly 48% from its November 2021 peak. And now, the S&P 500 Index is down around 16% from its all-time high back in January.

That tells us the shoeshine boy indicator worked yet again.

The moral of the story is simple…

A bear market was all but guaranteed when BUZZ launched. But now, this tool directly measures the proverbial shoeshine boy for us.

As a result, you’ll want to keep an eye on it.

Good investing,

Pete Carmasino