Deutsche Bank upgraded its outlook for one retailer last Monday, just ahead of earnings…

Why do analysts always try to time the market before earnings?

It doesn’t seem like a smart bet to turn optimistic on this retailer today, either…

Consumer debt is at an all-time high. And delinquencies are rising. Plus, the Federal Reserve plans to push interest rates even higher. That’s a bad setup for the retail space.

Now, this particular retailer might seem like it will do well in a tough economy. In fact, it’s a poster child for “recession proof” businesses.

But the thing is… higher prices can hurt this business just like any other company.

And sure, as a stock’s share price drops, it can look more attractive. But when the market is telling you from a “relative strength” standpoint to avoid a stock… you should do that.

As I’ll show you, that’s happening with this retailer today…

Deutsche Bank believes it’s a good time to buy. But the Power Gauge is saying the opposite. And after the company’s latest report, our system appears to be making the right call…

The retailer I’m talking about is Dollar Tree (DLTR).

As I said, a week ago, Deutsche Bank called the stock a “top pick within [the retail] group.” And it suggested capitalizing on “any share price weakness coming out of earnings.”

But the Power Gauge disagrees…

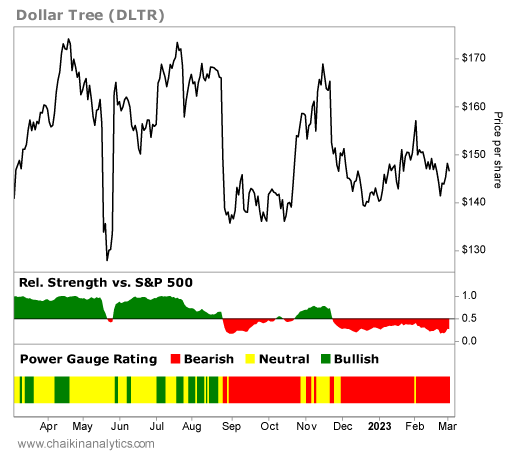

Our system rates Dollar Tree as “very bearish” overall today. And as you can see in the following chart, the stock has underperformed the broad market for several months…

Before last week, Dollar Tree last reported earnings in November. And the relative-strength panel on the chart shows that its stock hasn’t kept pace with the S&P 500 Index since then.

It’s as simple as can be… Dollar Tree isn’t the opportunity that Deutsche Bank thinks it is.

Dollar Tree actually reported solid earnings. But that’s about what happened in the past. “Guidance” is more important because it tells us what the company expects going forward.

And Dollar Tree’s guidance was terrible…

The company previously projected $7.78 in earnings per share (“EPS”) this year. But it now estimates its EPS to be between $6.30 and $6.80 per share. That’s up to a 20% difference.

Now, in fairness to the Deutsche Bank analyst, she noted that Dollar Tree would likely have poor guidance. And she said the investment bank was “bracing for more volatility ahead.”

I also realize that Dollar Tree is a discount store. It could fair well if inflation continues to run rampant in our economy. But importantly… the company isn’t immune to higher prices.

After all, Dollar Tree was forced to raise its prices from $1 to $1.25 last year. And it’s also planning to start another line of stores with products in the range of $3 to $5 each.

Higher price points might lead to higher margins. But they might not.

How long will that strategy take to play out? Will it require more investment in labor and materials? And what if inflation is even higher by the time this new initiative takes hold?

With so many questions, it’s hard to call Dollar Tree a “top pick” like Deutsche Bank did.

So be careful when you see these types of headlines in major financial news outlets…

Wall Street analysts aren’t looking out for your best interests. They’re in it to make money.

Meanwhile, the Power Gauge is unbiased. And it’s “very bearish” on Dollar Tree today.

Good investing,

Pete Carmasino