The Federal Reserve is raising interest rates.

And Fed Chairman Jerome Powell has made it clear that he’s focused on fighting inflation…

In mid-May, Powell said he would tackle the problem of rising inflation. And even “if that involves moving past broadly understood levels of neutral, we won’t hesitate to do that.”

That’s Fed-speak for “We’re not afraid of pushing the economy into a recession to stop inflation.” And Powell meant it…

Interest rates are soaring. The yield on the 10-year U.S. Treasury note hit an all-time low of 0.52% in August 2020. Today, less than two years later, it’s at more than 3%.

Now, that increase might not sound like much. After all, a 2.5% rise on the price of a gallon of milk is roughly 11 cents.

But in monetary-policy terms… these rate hikes are massive.

In fact, this is exactly how the Fed causes recessions…

You see, rate hikes aren’t about making things like milk and eggs more expensive. Instead, they make debt more expensive.

That’s true for both consumers and businesses. And the rising cost of debt is what pushes down economic growth.

It’s a little convoluted. But as consumers, we can measure the effects of rising rates in a simple way…

I’m talking about mortgage and refinance demand.

And today, the data is as clear as it gets… Powell and the Fed are getting exactly what they want.

Let’s look at how we know that’s true. And we’ll also see how that translates into recessionary pressure…

It’s one thing to know rising rates increase the cost of debt. But it’s another thing to feel it.

Right now, homebuyers are feeling that pressure firsthand. And they’re responding…

In short, mortgage demand is at its lowest level in 22 years. And refinance demand is down 75% from the same time last year.

Now, maybe you’re thinking, “Of course homebuying is slowing. Look at how crazy the housing market got.”

But the reality is… when it comes to long-term debt, interest rates, not high prices, determine how hot the market runs.

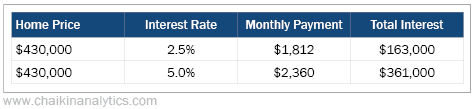

In the following table, you can see why interest rates matter. Take a look…

This example involves two 30-year home loans. Notice that both homes cost $430,000. That’s roughly in line with the current U.S. median home sales price today.

Now, look at the interest rate on the loan. It changes from 2.5% to 5%. And as you can see, that makes all the difference…

The buyer’s payment price would increase from $1,812 to $2,360. That’s a 30% jump!

Over the life of the loan, the consequences are even greater. The total interest paid would soar a staggering 121%.

So it’s no wonder that homebuying is slowing today…

Even a seemingly small increase in rates makes the payment on a new home much more expensive. In the end, those rising rates more than double the cost of the interest.

That’s true for consumers like us. And it’s also true for businesses…

Businesses do almost everything with debt.

So rapidly rising rates make the cost of doing business more expensive. And most businesses make the same calculation that would-be homebuyers do…

When debt is cheap, they feel like they can afford to do or buy anything. But when debt is expensive, they decide to pass on previously obtainable purchases.

That shift causes recessions. And it’s exactly the environment we’re in right now.

Until the Fed lets off the brakes, we’ll continue to face this kind of recessionary pressure.

As you saw, it’s just basic math.

Good investing,

Carlton Neel