For decades, British coal miners used a unique system to detect danger…

Canaries.

You see, canaries are more sensitive to carbon monoxide and other deadly gases than humans. So if the birds got sick, the coal miners would head for fresh air.

British coal miners used canaries from the early 1900s through the mid-1980s. That’s when electronic sensors replaced them. The system was also used in the U.S. and Canada.

Canaries saved hundreds – if not thousands – of lives over the years.

These days, the phrase “canary in the coal mine” is used to describe any early indicator of potential danger or failure. And it’s especially common in the investing world…

At this point, you know all about the banking industry’s problems over the past month.

It might seem like the trouble came out of nowhere. But as you’ll learn today, there was a canary in the coal mine. And it could’ve alerted investors to the danger back in November…

The financial stock that got sick first was Lincoln National (LNC).

Lincoln is a well-known, Pennsylvania-based insurance company. It sells life, health, and group insurance. And it offers products for long-term care and annuities as well.

Through last fall, everything seemed normal with Lincoln…

AM Best, the business that rates insurance companies, gave it an “A+” rating for Financial Strength. And AM Best gave it an “aa-” rating for Long-Term Issuer Credit.

But this canary in the coal mine got sick in November…

By that, I mean Lincoln reported an adjusted loss of $10.23 per share in the third quarter. That was much worse than its $1.62 in earnings per share in the third quarter of the previous year.

Like banks, insurers invest capital after bringing in clients’ money. And soaring interest rates put incredible pressure on Lincoln’s business – just like they did with the failed banks.

Lincoln’s stock plunged 33% in one day after its earnings report came out. And the downtrend has continued since then. It’s now down roughly 58% from its November peak.

Put simply, Lincoln has gotten crushed. And its problems surprised many investors. Heck, AM Best didn’t even downgrade its rating until a week after the company’s earnings report.

But with the right tool, you could’ve seen the trouble with Lincoln as it played out in real time. And you could’ve prepared for more pain in the financial sector…

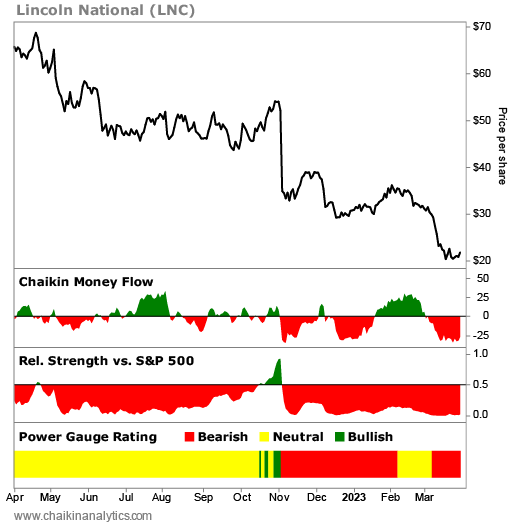

Regular readers know the Power Gauge is our trusted system. It updates daily. And in Lincoln’s case, as soon as the trouble was known… it flipped from “bullish” to “bearish” overnight.

Take a look…

This saga shows why it’s crucial to have a ratings system for stocks that works daily…

The Power Gauge had the information at hand. It rated the stock as “bullish” until new information surfaced. And as soon as that happened, it flipped to a “bearish” grade.

AM Best took much longer. It didn’t downgrade the company until a week later.

More importantly, Lincoln was the canary in the coal mine for financial stocks…

Silicon Valley Bank and Signature Bank (SBNY) blew up in early March. But with the Power Gauge at your side, you could’ve seen this canary get sick months before the crisis.

Good investing,

Pete Carmasino