I was born too early…

Decades ago, many kids’ lives revolved around team sports. If you were a good player, other kids accepted you – even if you were a jerk.

Well, I wasn’t made for team sports… My high school football coach had enough sense to cut me before the end of spring practice during my first year. That was my best sport, too.

The thing is, if I would’ve been born in 2000 or later, I might’ve become a sports star…

That’s because team sports are no longer the only game in town. For nonathletic kids everywhere these days, it’s a dream come true…

I’m talking about esports, of course.

Two recent acquisitions show us that competitive video gaming is only getting bigger. But as I’ll explain today, that doesn’t mean investors should rush to join the buying spree…

On Tuesday, tech giant Microsoft (MSFT) announced that it would buy leading video-game maker Activision Blizzard (ATVI) for about $69 billion. And last week, Take-Two Interactive Software (TTWO) said it planned to buy Zynga (ZYNG) in a deal valued at nearly $13 billion.

In short, video-game companies are big prizes today. That’s not surprising…

“Content is king” has been discussed for decades. It became the rallying cry as consolidation occurred in movies, music, and publishing… So why not video games, too?

Video games have also developed into a vibrant social scene for introverts…

Skilled gamers can make a lot of money if they can get strangers to log on to platforms like Twitch and YouTube to interact and watch them play. These interactions can generate subscription and ad revenue, which the platform and the player (or “streamer”) share.

Despite these positives, it’s hard to find video-game stocks worth buying right now.

Our Power Gauge system shows us that U.S.-traded video-game makers Take-Two, Electronic Arts (EA), and South Korea-based Gravity (GRVY) are all rated as “neutral” or “neutral+” today… They don’t present the best opportunities at the moment.

You can’t invest directly in Twitch or YouTube, either. They’re owned by Amazon (AMZN) and Alphabet (GOOGL), respectively… And although streaming is gaining popularity, these platforms are still too small to drive the stocks of their gigantic corporate parents.

You could consider investing in some of the smaller social-gaming platforms. But unfortunately, at least for now, they’re heavily focused on China… And the Chinese government is trying to restrict the amount of time that kids spend playing video games.

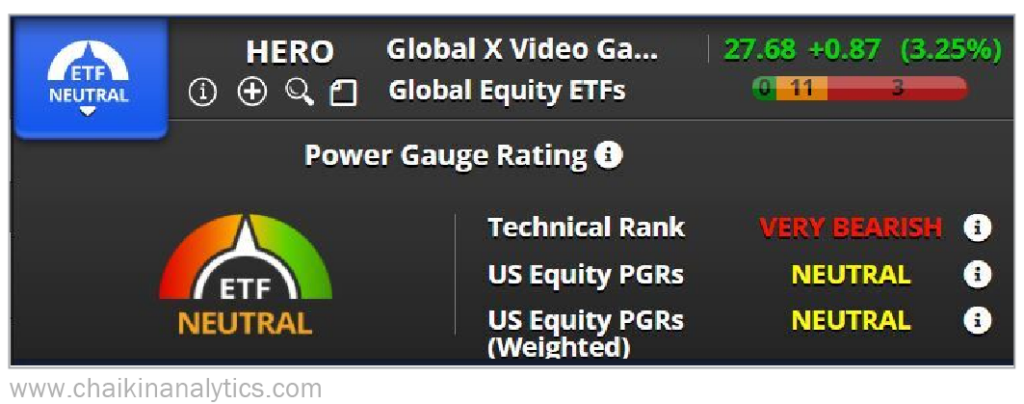

The Global X Video Games & Esports Fund (HERO) could be a great way to diversify your risk in the space… It holds 40 stocks today – including all of the video-game makers we’ve discussed and foreign stocks like Nintendo, Ubisoft Entertainment, Konami, and more.

However, with a “neutral” overall rating, the Power Gauge urges us to be cautious right now…

Activision Blizzard might turn out to be a great purchase for Microsoft. And Take-Two could keep shining for years to come with Zynga under its umbrella.

But the Power Gauge shows us that the companies still available to us aren’t resounding buys today. So you’re better off waiting on the sidelines of this burgeoning sport for now.

In other words, think twice before jumping in on the esports party today. You’ll likely get a better chance to buy at some point down the road.

Good investing,

Marc Gerstein