At first glance, the investing landscape seems to be improving…

Despite pulling back yesterday, the S&P 500 Index is still up about 8% from its October bottom. And the tech-heavy Nasdaq Composite Index is up around 4% over that period.

Inflation is cooling off, too…

Earlier this week, the latest Consumer Price Index update came in at 7.1%. That’s still near multidecade highs. But it’s a big improvement from where we were just a few months ago.

With all that said, the Federal Reserve still holds the market’s life in its hands…

Chair Jerome Powell made that clear with his comments after the Fed’s December meeting ended this week. And the central bank’s latest 0.5-percentage-point hike to the benchmark interest rate reminded the markets that its “hawkish” position isn’t changing anytime soon.

Now, it appears that the market’s bottom will come slightly later than I previously expected. Specifically, a new low will likely occur in the first quarter of 2023. Here’s why…

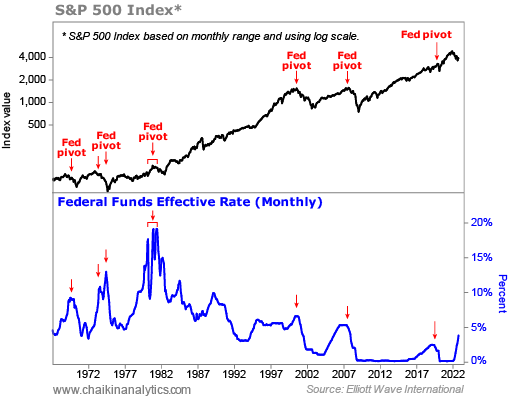

I’m sure you’ve heard the “Fed pivot” thesis by now. It’s the idea that inflation will cool, the Fed will lower rates, and the market will go right back to normal.

It’s an appealing idea. After all, everyone wants the good times to return.

But market pundits are making a big mistake if they expect the Fed to pivot and a stock-buying rush based on that hope. As I’ve said before, “hopium” could wreck your portfolio.

For nearly 70 years, no bear market has ended until the Fed lowered interest rates.

Powell just said yesterday that the Fed isn’t pivoting yet. But even if it did, the data shows that we would still need to deal with more volatility in the markets for some time.

Investors should be careful what they wish for.

The following chart goes back to the 1970s. The majority of bear market declines over that span occurred after the Fed’s pivot. Take a look…

In other words… based on past bear markets and accompanying rate-hike cycles, another shoe could still drop in the stock market as we head into the new year.

Ultimately, bear markets usually end in panic and capitulation followed by a Fed rate cut.

Sure, today’s market conditions are painful. But we’re nowhere near panic.

In fact, none of these things has occurred yet in this cycle. That’s why we should prepare our portfolios for at least one more sell-off in stocks in the months ahead.

Meanwhile, it might be tempting to “bottom fish.” By that, I mean you might want to scoop up stocks that have underperformed the market so far in 2022.

Resist the temptation.

Many of these stocks were former high-flyers that crashed hard. They include “meme stock” favorite GameStop (GME) and software businesses ServiceNow (NOW) and Atlassian (TEAM).

If you’ve taken your cues from the Power Gauge like me, you’re probably not holding these stocks. But if you are, think about taking “tax losses” by selling into any year-end strength.

In the end, our takeaway is clear…

Right now, the Fed holds the market in its palm. Based on more than 100 years of data, more pain likely lies ahead for stocks. That’s the environment we’re living in.

Now, we just need to adjust our strategy to make sure it’s in line with that reality…

Opportunity still exists out there. We just need to look for it in the right places.

Good investing,

Marc Chaikin

P.S. I hope you’ll make some time this weekend for my urgent Fed update…

The central bank’s rate hikes have rattled the markets for months. But the Fed’s next move is what could decide whether you make or lose money in the early days of 2023.

I’ve prepared a special presentation to help you learn all about what’s coming. And I’ll show you exactly what to do with your money before January 1. Watch the presentation here.