Regular Chaikin PowerFeed readers know all about the Power Gauge…

Chaikin Analytics founder Marc Chaikin came out of retirement to build this powerful system. And he set out to help individual investors level the playing field with Wall Street.

The Power Gauge uses 20 individual factors to analyze more than 4,000 stocks and exchange-traded funds. And it pulls all the data together to produce a single overall rating for each stock.

The Power Gauge’s overall rating spans seven distinct categories. It’s sort of like a seven-setting traffic light…

Now, astute readers will notice that this graphic only includes five categories – not seven.

That’s because the “neutral” category is hiding two more options. They are “neutral+” and “neutral-.”

These two categories can confuse Power Gauge users. You see, they don’t mean, “I don’t know.” Instead, they mean one of two things…

For “neutral+” stocks, the system is telling us that it likes something. And for “neutral-” stocks, it’s saying that it sees some bad stuff. And given what the Power Gauge’s 20 factors reveal at the time, the stocks’ prices aren’t behaving as we might expect.

That sounds simple enough. But it’s important to know the “why” behind these ratings. They have big investment implications…

Put simply, I love looking into “neutral+” stocks. And I know to avoid “neutral-” stocks.

Today, I’ll pull back the curtain on this part of the Power Gauge. We’ll learn exactly why that’s the case…

In short, the Power Gauge wants to give “bullish” or better ratings to “neutral+” stocks. But it doesn’t because these stocks are trading below their long-term moving averages.

So instead, the Power Gauge assigns a “neutral+” rating. It’s a call to attention…

When a stock crosses below its long-term moving average, it can be a warning signal. These stocks are often headed for tougher times. But that isn’t always the case…

“Good stocks” can dip below their long-term moving averages as well. But once these “neutral+” stocks are there long enough, they tend to bounce back and continue to soar higher.

That’s why I love “neutral+” stocks. These stocks are already below their long-term moving averages. They’re more likely to bounce back sooner.

They offer great “hidden” opportunities. And our data from the Power Gauge backs that up…

“Neutral+” stocks outperformed across every holding period last year. In fact, in some scenarios, they fared almost as well as “very bullish” stocks.

And the opposite holds true for “neutral-” stocks…

The Power Gauge wants to assign “bearish” ratings to “neutral-” stocks. However, their recent price action contradicts that rating…

These stocks are actually trading above their long-term averages. But the Power Gauge is telling us that something isn’t right with the company.

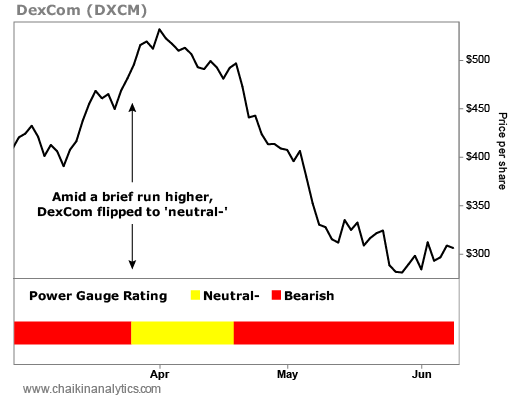

So in the short term, I avoid “neutral-” stocks. They show signs of reverting down in the future. Here’s a nasty example – health care equipment maker DexCom (DXCM)…

As you can see, the Power Gauge turned “neutral-” at the end of March…

The stock earned that rating in the middle of a brief run higher. But importantly, beneath the surface, the Power Gauge still viewed DexCom as a “bearish” stock.

Not surprisingly, DexCom turned lower again in April. And the stock continued its overall downtrend. It’s down roughly 50% since its November 2021 peak, including around 38% after the “neutral-” tease earlier this year.

That’s why I avoid “neutral-” stocks.

So if you’re looking for opportunities in this volatile market, my advice is simple…

Never stray into the land of “neutral-” stocks. But remember, “neutral+” stocks are nearly “bullish” or better. They’ve simply had a rough time in the markets in the short term.

If you want to uncover a contrarian opportunity, start your research with these stocks.

Personally, I love looking at “neutral+” stocks. You’ll likely find some hidden winners, too.

Good investing,

Karina Kovalcik