Folks, the financial news is full of negativity these days…

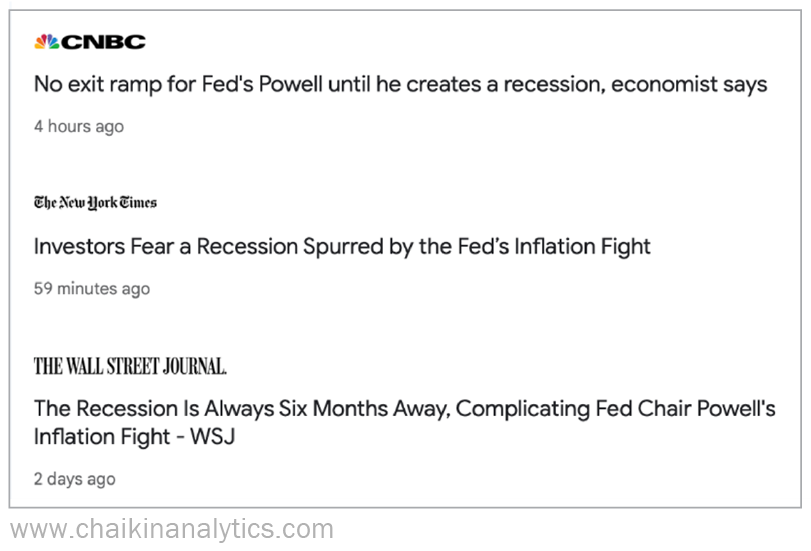

Most pundits are still calling for a recession or major wipeout. Take a look…

But as regular Chaikin PowerFeed readers know, the technical details behind the market today are very different. And we’re already seeing the beginnings of the next bull market.

Does that mean everything will be smooth sailing from here?

No way.

In fact, there’s still a decent chance of an “earnings recession” ahead. And history tells us to expect multiple pullbacks as the market’s next bull phase plays out.

But that doesn’t mean you should shift completely to defense.

Now, I know that we’ve already covered this topic recently. However, the market is choppy right now. So it’s darn important for you to remember. That’s why I’m reiterating it today.

The Power Gauge confirms what I’m saying…

One of the most defensive positions of all now earns a “very bearish” rating from our system. Worse still, according to the Power Gauge, it’s the worst-rated market sector today.

So the pundits are full of uncertainty. And you might be confused about what to do with your money.

But the Power Gauge is clear…

If you’re investing in this defensive position right now, you’re in for trouble.

Let me show you what I mean…

Folks, the defensive position we’re talking about is the utilities sector.

The utilities sector is about as boring as it gets. And because of that, many investors see it as a “safe haven” for their money. That’s true even if the data behind the idea is a little complicated.

Here’s the important part for us…

The utilities sector is underperforming the market so far in 2023. Take a look…

Since the start of the year, the Utilities Select Sector SPDR Fund (XLU) has lost roughly 8%. And the broad market S&P 500 Index has gained around 4% over that span.

That’s a major wipeout. And according to the Power Gauge, it’s likely to get worse…

You see, XLU currently earns a “very bearish” rating from the Power Gauge. And beyond that, zero of the 30 rated stocks in the exchange-traded fund are rated “bullish” or better.

That means the Power Gauge isn’t optimistic on any of these 30 stocks within XLU.

That’s as clear as it gets…

Defensive plays like utilities are the wrong place to be looking right now. And although the Power Gauge is “neutral” on the S&P 500 as a whole, it’s finding plenty of opportunities…

Four sectors and 12 subsectors currently earn a “bullish” or better rating. And within the S&P 500, 133 stocks are rated as “bullish” or better right now.

Put simply, even if the market is volatile… we can find plenty of opportunities.

So with that in mind, let’s do our jobs as investors. Let’s go out and find the best opportunities, no matter what’s happening in the overall market.

To do that, I’ll use the Power Gauge. After all, it’s the culmination of my life’s work.

But whatever tool you use, just make sure it’s not telling you to bury your head in the sand.

Now, more than ever, that’s exactly the wrong position to take in your investing approach.

Good investing,

Marc Chaikin