We’re fast approaching the end of 2022. And as you know, it has been a wild ride…

The broad market S&P 500 Index remains down around 14% this year. And the tech-heavy Nasdaq Composite Index is still down about 24% from its November 2021 peak.

Despite that poor performance, regular readers know new opportunities are starting to develop. Wall Street has cooled its “run for the hills” mentality in recent weeks.

The Power Gauge currently points to opportunities in several “bullish” sectors and subsectors. And that means investors who know where to look could realize big gains.

But no matter what… you’ll want to avoid one sector at all costs.

You see, this sector is particularly sensitive to interest rates. And as we all know, the Federal Reserve is frantically raising rates in an attempt to cool inflation.

So if you know what’s good for your portfolio, you’ll steer clear of this sector for now.

Let’s get into it…

In short, we’re talking about the real estate sector.

The Real Estate Select Sector SPDR Fund (XLRE) is down roughly 16% this year. This exchange-traded fund also earns a “bearish” rating from the Power Gauge today. And none of the 31 stocks that the Power Gauge tracks within XLRE have a “bullish” or better rating.

I urge you to avoid “buying the dip” in this space. And the reason is simple… the Fed.

Now, we can slice the macroeconomic conditions facing the real estate sector in 100 different ways. And it’s true that America still needs more housing to meet demand.

But in the end, the old adage, “Don’t fight the Fed,” holds true for real estate today…

The problem is that small changes in interest rates mean big changes in the cost of debt. And that matters a lot for homebuyers, builders, and commercial real estate developers.

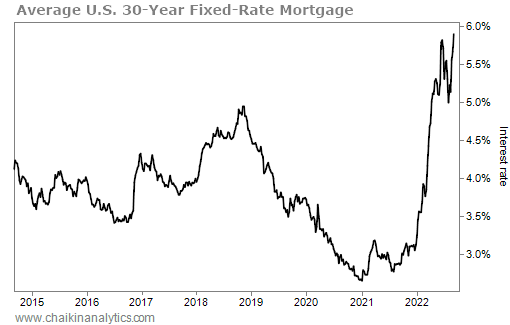

Take a look…

The average 30-year fixed-rate mortgage in the U.S. bottomed in early 2021 at about 2.7%. Today, it’s at roughly 5.9%.

That might not sound like much of a change. But it’s huge for buyers who need loans (which is almost everyone)…

The median U.S. home price has skyrocketed over the past couple of years. It’s at roughly $440,000 today.

At an interest rate of around 2.7%, the mortgage payment for the median home would be about $1,780. For many Americans, that was a manageable number.

But at today’s 5.9% rate, the payment comes in at around $2,440. That’s a roughly 37% increase.

In other words, the cost of servicing debt has increased by more than a third. It happened fast, too.

And even worse, there’s still more pain ahead…

Inflation continues to hover around 40-year highs. And Fed Chair Jerome Powell is clear on the issue…

According to Powell, the central bank will “use [its] tools forcefully” to attack inflation. And as the Fed does that, it will create “some pain” for Americans.

As long as this trend is in place, we can expect real estate to suffer.

The Power Gauge is clear on this point as well. Right now, real estate is the worst sector in our system.

Look for opportunity elsewhere today.

Good investing,

Marc Chaikin