If anyone in the market was still optimistic… last week’s news likely killed that.

The latest Consumer Price Index (“CPI”) numbers came out Thursday morning. And they were hotter than economists expected…

Specifically, the CPI rose about 0.4% in September over the previous month. Or to put it more simply… the costs of goods that Americans depend on went up yet again.

Now, 0.4% might not sound like much. But it’s a huge deal for investors…

As you likely know by now, inflation is the driving economic topic of the year. And the Federal Reserve is fighting inflation by raising interest rates.

The idea behind the Fed’s action is simple…

Higher rates make the cost of doing business more expensive. And in turn, that slows down the economy.

It’s now nearly guaranteed that the Fed will raise rates again at its next meeting in early November. In fact, traders betting on rate changes expect another 75-basis-point increase.

In the Power Gauge, nearly every glimmer of hope has faded as well. And it’s obvious that the market has taken a turn for the worse in recent weeks.

But fortunately, that doesn’t mean we’ve completely run out of opportunity…

Without question, we’re in a challenging environment right now.

The S&P 500 Index is down roughly 25% this year. The tech-heavy Nasdaq Composite Index has lost around 35%. And of course, many individual stocks have fared even worse.

However, pockets of outperformance still exist…

For example, regular Chaikin PowerFeed readers know that I’ve pointed to the energy industry as a source of opportunity many times this year. And as paid subscribers know, I’ve referred to this year’s market downturn as an “everything but one” crash.

Folks who invested in the Energy Select Sector SPDR Fund (XLE) in January would be up roughly 45% this year. And even investors who just bought three months ago – after the exchange-traded fund came off its all-time high – would still be up around 20%.

If you’re looking for individual stocks, opportunities still exist there, too…

I recently set up a screen in the Power Gauge to help me find large-cap stocks with “bullish” or “very bullish” ratings that are at or near three-month highs.

In other words, I’m looking for stocks that are bucking the most recent leg of the downturn. I want to find stocks that are doing well despite the negative overall outlook today.

The results are straightforward. As of last Thursday’s close, 31 stocks fall into this category.

The vast majority of these stocks are related to the energy industry. The list also includes health care and pharmacy stocks – along with some consumer-staples companies. It features some “insurance” heavy hitters that you’d expect to see at a time like this, too.

I’d love to share the full list with you. But that wouldn’t be fair to our paid subscribers.

Still, today, I can draw your attention to one company in particular…

Folks, it’s grim in the markets today. But if anyone will profit when inflation pummels U.S. consumers and the economy slows… it’s the market leader in canned soup.

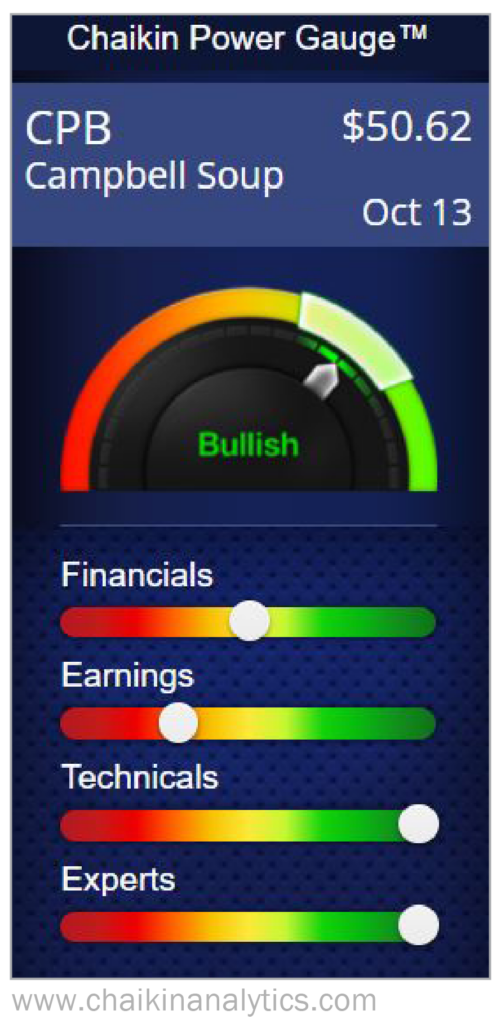

In fact, despite less-than-ideal grades in the Financials and Earnings categories, Campbell Soup (CPB) is “bullish” overall in the Power Gauge today. And the stock has significantly outperformed the S&P 500 this year. It’s up roughly 15% so far in 2022.

Even better… it just triggered a “momentum breakout” signal in the Power Gauge.

Now, that’s nowhere near the soaring performance of the energy sector. But a roughly 15% gain is still incredible when the S&P 500 is down about 25% over the same span.

With inflation soaring, I bet more consumers will turn their attention to this budget-friendly food company. So I wouldn’t be surprised if its upward march continues from here.

Good investing,

Marc Chaikin