Most folks don’t understand how the Volatility Index (“VIX”) really works…

Like many financial tools, it’s somewhat convoluted.

Most people think the VIX measures the current volatility of the market. But in reality, the VIX actually measures how much volatility investors expect over the next month.

Essentially, the Chicago Board Options Exchange designed a formula using options to give investors a useful way to measure market expectations…

When the VIX spikes, it tells us that investors expect a bumpy road ahead. And if it’s low, it means investors anticipate relative calm in the markets.

That brings us to an important distinction. In short, instead of telling us current market conditions, the VIX measures how people feel things will happen moving forward.

And right now, folks are feeling pretty extreme… The VIX has roughly doubled this year.

We’ve discussed market volatility a lot recently. But with the VIX climbing to an extreme level, it’s telling us that investors expect we’ll need to deal with the volatility even longer.

As I’ll explain, today’s extreme measure in the VIX has big implications for the market’s future returns. And it’s likely not what you would expect…

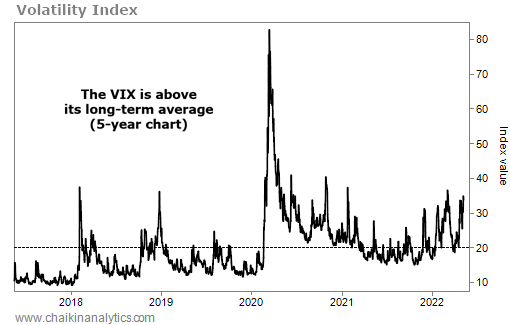

Let’s start with the VIX’s five-year chart…

Notice that the VIX is well above its long-term historical average of roughly 20. That’s still true even though it has come down significantly from the initial COVID-19 panic.

People still expect rough times ahead. But there’s something funny about that…

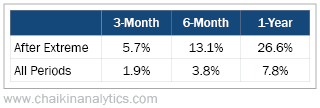

The VIX is at about 33 right now. That’s near a key point of 35. Since 1990, when the VIX has exceeded 35, the S&P 500 Index has produced the following returns…

That’s significant outperformance over all three time frames.

But importantly, the VIX hasn’t exceeded 35 yet. And I need to be clear…

With everything going on in the world right now, this isn’t a cut-and-dried indicator.

The stock market is fighting against several strong headwinds. It’s battling soaring inflation, rising interest rates, war, supply-chain issues, labor shortages, and other obstacles.

So remember, the VIX isn’t the only thing that rules the stock market. What happened in the past doesn’t always happen in the future. And the stock market still needs to overcome the challenges just mentioned.

Put simply, things could still get worse before they get better. That’s why I would wait for the trend to change back in your favor before going “all in” on the stock market.

With that said, history points to big upside potential once the tide turns.

Don’t let fear prevent you from missing that opportunity.

Good investing,

Karina Kovalcik