Folks, a new opportunity just appeared in tech stocks…

The Power Gauge is now “bullish” on the Technology Select Sector SPDR Fund (XLK).

XLK hasn’t earned a “bullish” rating since early January. Our system shifted to “neutral” around when the broad market peaked. So this new signal is obviously a big deal.

But importantly, we can’t take that as a license to back up the truck on all tech stocks…

I also track two other tech-focused exchange-traded funds (“ETFs”) – the Invesco QQQ Trust (QQQ) and the SPDR FactSet Innovative Technology Fund (XITK). And right now, both of these ETFs remain stuck in “neutral” in the Power Gauge.

So as investors, what should we do about these mixed signals?

We’ll answer that question today. As you’ll see, not all tech stocks are up to speed yet…

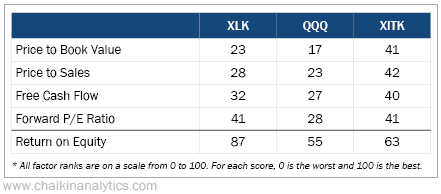

For each of these three ETF portfolios, I calculated weighted average Power Gauge factor ranks (based on each stock’s allocation within its respective ETF).

You’ll notice that all the factor ranks in the following two tables are on a zero to 100 scale.

That means you don’t need to worry whether higher or lower data points are better for any particular factor. We’ve set it up so that when you see a factor rank, you can always assume 100 is the best.

Let’s dive right into the deep end…

For tech stocks, that means valuation. We’ve all heard about bursting tech bubbles, after all.

Don’t get bogged down in the details. Just run your eyes over the table and ask yourself…

Is XLK meaningfully better, worse, or about the same as the other two ETFs?

Based on the first four valuation ratios, XLK isn’t terrible. But it’s definitely not the winner. That honor goes to XITK. And the popular QQQ is clearly the loser.

The last row of the table gives a clue as to what we might expect as we move on…

This is the five-year average return on equity. It measures how many cents of profit a company earns on each dollar of equity capital. It’s a terrific measure of company quality…

This metric combines margin (profit per item) and volume (number of items). And it’s comparable across different companies and different businesses.

With a score of 87, XLK is the clear winner in this factor.

From the first table, we learned that XLK’s holdings have high valuation ratios.

But true value analysis isn’t just about low ratios. High – even very high – valuation ratios are OK if a company’s growth expectations are strong… and credible.

That brings us to the next table. It shows several factors from the Technicals and Experts categories of the Power Gauge. They help us tap into credible expectations about the future.

Now, the table includes a lot of numbers. Again, don’t obsess over each one. Just scan the table to get a feel for which ETF generally receives the highest marks…

You can see that XLK wins almost every category in this section – often by a lot.

And it wouldn’t receive high scores in these categories unless “they” expect good things down the road. “They” consists of various groups within the investment community who are especially knowledgeable…

Look closely at the Chaikin Money Flow. This is Marc Chaikin’s proprietary measure of the impact of the “smart money” – institutional investors. You want to follow these folks. When they put money behind an investment, they’re often right.

And as you can see, the Chaikin Money Flow tells us these folks favor XLK today.

Big-time short sellers are pretty smart, too. They can lose a lot of money quickly if they mess up. And the “90” score for XLK in this factor tells us that these professional bears are running away from the stocks in this ETF right now.

Overall, the stocks in XLK have high valuations today. But with the Power Gauge’s help, we can see that they’re supported by credible growth expectations.

Folks, for the first time since the start of this year… opportunities exist in the tech sector.

XLK holds a bunch of good companies to choose from. You could just buy shares of that ETF. Or you could do some homework to find the most attractive opportunities within it.

However, it’s not time to put everything into any tech stocks just yet. As we’ve seen today with QQQ and XITK, they’re not on the same level as XLK.

That’s why it’s always critical to pick and choose. Don’t just blanketly throw money at tech.

Good investing,

Marc Gerstein