Meals went cold. Some customers waited hours for their supposedly “free lunch.”

The crush overwhelmed kitchen workers all over the city.

But it wasn’t the restaurants’ fault… A third-party website offered a special promotion. This website is a regular thorn in restaurant owners’ sides.

Not surprisingly, the website crashed – twice. It couldn’t handle the flood of 6,500 orders per minute.

And the restaurants couldn’t do anything to stop the orders.

Sure, they could’ve closed their doors and went home. But even then, the orders would’ve likely still poured in. The restaurant owners don’t control the website, after all.

Folks, this isn’t some made-up scenario. It just happened on Tuesday.

So-called “gig economy” company Grubhub is to blame…

You see, Grubhub effectively offered a “free lunch” to all of New York City. It offered a “Place an order and get $15 off” promotion to customers.

And it worked… too well. Now, the company is doing damage control…

Dave Tovar, Grubhub’s senior vice president of communications and government relations, is trying to clean up the mess. On Wednesday, he said, “What that did across our entire platform, obviously, caused some unintended consequences.”

But folks, unintended consequences are a feature of the gig economy – not a one-off bug. The Power Gauge sees that, too.

So today, let’s look at the Power Gauge ratings for two other gig-economy companies…

If we could, we would start with Grubhub’s Power Gauge rating. But its parent company delisted from the Nasdaq stock exchange back in February.

That’s an ominous sign considering Grubhub’s ubiquity. That’s the struggle for gig-economy companies, though…

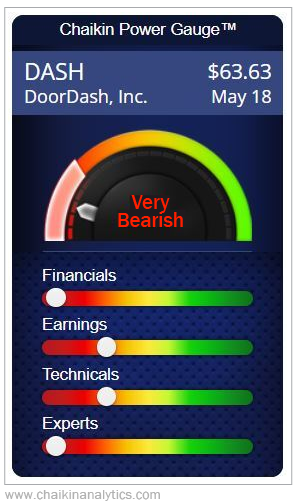

Take a look at major competitor DoorDash (DASH) as an example…

As you can see, DoorDash earns a “very bearish” overall rating from the Power Gauge today. And the four main factor categories are all in the red – “bearish” or worse.

Remember, the Power Gauge analyzes 20 individual factors. Then, the Power Gauge sorts those factors into four categories – Financials, Earnings, Technicals, and Experts.

A proprietary weighting system brings it all together. And in the end, you get a single overall rating. Again, for DoorDash, the Power Gauge’s overall rating is “very bearish.”

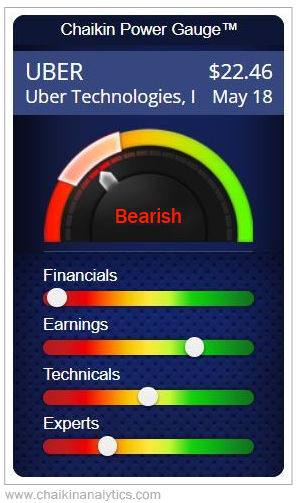

Gig-economy competitor Uber Technologies (UBER) is in a tough spot, too. Take a look…

Now, compared with DoorDash, Uber is on slightly firmer footing. But company still earns a “bearish” rating from the Power Gauge.

We could dig through each company’s 20 individual factors to figure out exactly why they’re struggling. But I think the answer is clear…

They’re all “free lunch” companies.

Put simply, these businesses rely on the infrastructure of others. And they offer discounts designed to grow their subscriber pool.

The problem is monetization…

Uber, DoorDash, and the recently delisted parent company of Grubhub all have this problem. Their pricing isn’t in line with profitability.

Sure, they have a lot of users… But they’re essentially offering a free lunch. And who wouldn’t want a free lunch?

When it comes to your investments, the Power Gauge is clear… These “free lunch” companies earn “bearish” and “very bearish” ratings today.

I recommend you heed this warning.

Good investing,

Carlton Neel