Avalara (AVLR) intrigues me…

You’ve probably never heard of the company. In short, it aims to be a leading global cloud-based, tax-compliance platform. And it went public in mid-2018 in pursuit of that dream.

Sure, it sounds like a snooze.

Thrill-seeking investors don’t seek out tax-compliance companies, after all. But for businesses that operate across national boundaries, Avalara sounds like a godsend.

So I find its story compelling. And I’d love to be able to buy shares… But I can’t.

Well, at least not today.

You see, Avalara is a “basement-dwelling kid.” And as I explained yesterday, if you’re not careful, companies like that can absolutely clobber your overall returns.

But the thing is… a big asterisk hangs over this concept. And it’s darn important because…

At times, basement kids can – and do – soar.

Let me explain…

Even before I focused on Avalara’s Power Gauge “bearish” overall ranking, two things irked me in our Chaikin Analytics system. Both its “P/E” (price divided by the estimate of next year’s earnings per share) and “ROE” (five-year average return on equity) were negative.

Yesterday, I discussed how these factors and a company’s operating margin help us assess the viability of a business. And I explained why this combination is a warning sign.

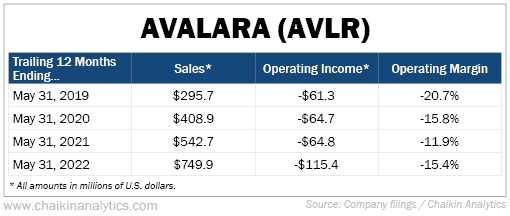

With Avalara, this warning sign is as clear as it gets. Take a look…

The company continues to lose money. Over the 12-month period ending in May 2021, it lost nearly $65 million. And that happened even though its sales totaled nearly $543 million.

So that’s it… Avoid the stock. Nothing more to see here. We’re done.

Well, maybe not.

You see, at times, the Power Gauge gives Avalara a “thumbs up.” That even included times when the company generated operating losses.

And the thing is… The Power Gauge was right.

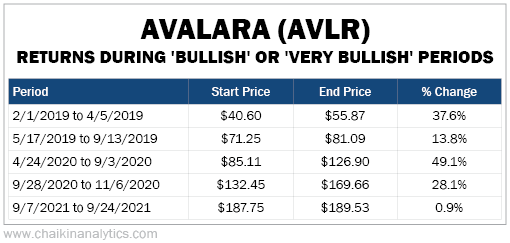

The stock performed well over those periods. In the most recent five examples, investors made money.

They even saw a return as high as 49% in less than five months. Take a look…

As we’ve said before, the Power Gauge’s rating is a summation of 20 different factors. These 20 factors all work together to integrate the three main things that move every stock…

- Measures of Valuation

- Indicators of Company Quality

- Expectations of Future Growth

Avalara is consistently lackluster in the valuation and quality measurements. But that didn’t stop the stock from soaring when investors had high expectations of future growth.

Folks, the point here is simple… Stocks like Avalara rally when they do because of expectations.

But be warned…

For so-called growth companies – especially emerging ones – expectations can change often. And in a market downturn like what we’re in right now, that can happen quickly.

So as investors, I recommend that you check the P/E and ROE for each of your holdings. If they’re both negative, keep your positions in these kinds of stocks on short leashes.

Notice that I didn’t tell you to avoid these situations altogether. If the Power Gauge ranks these stocks favorably – like it did for Avalara on several occasions in recent years – they could be OK to buy.

But as always, you need to stay alert. Make sure you do the proper research. And know that expectations of future growth – not present-day fundamentals – are driving the price action.

When expectations change, the company can instantly switch from high-flying growth stock to basement-dwelling portfolio destroyer.

So watch the Power Gauge closely. And be ready to step aside at the first sign of weakness.

Good investing,

Marc Gerstein