Gazprom took an extraordinary step last week…

In short, the majority state-owned Russian energy company said it would use “force majeure” to stop natural gas flows to Germany.

The term “force majeure” is in most contracts under the name of an “Act of God” clause. And if executed, it relieves the party of its contract obligations.

It’s a way of saying, “This situation is beyond our control.”

Gazprom used this loophole to cancel natural gas delivery to Germany. And the move came as the Nord Stream 1 pipeline to Germany underwent maintenance.

However, the maintenance ended yesterday. And for now, the gas is flowing again.

Now, just about everyone believes Gazprom aimed to send a message in response to Western sanctions against Russia. It claimed the pipeline might not be functioning properly because of a delay in fixing and returning a gas turbine from Canada.

So now, the big question is… will Russia turn the gas off again?

If Russia turns the gas off again, we’re in for a very rough ride. About a month ago, I described the world as nearing a “perfect storm” in the energy space.

The only way Germany and other European countries can survive is through a series of steps to reduce natural gas usage. And ultimately, that means using less electricity.

Germany has already started dimming its streetlights and limiting hot water. And the country is completely shutting down swimming pools in the middle of summer.

These efforts will likely mean complete blackout periods in the near future, too. And companies that rely on electricity to function will be under severe stress.

In turn, earnings will plummet. Put simply, any business that uses electricity will be doing less business. And well, that’s just about every business you can think of.

The quality of life without heat will be rough as well…

Germany’s average temperature is in the 30s during the winter. But no gas means no heat. It could lead to a southern migration not seen in a millennium.

UBS economists projected that corporate earnings could fall more than 15% if Russia ends natural gas deliveries to Europe. The report also noted that the Stoxx 600 (the main index in Europe) could crash 20% or more. And the euro’s value compared to the U.S. dollar could fall to 90 cents.

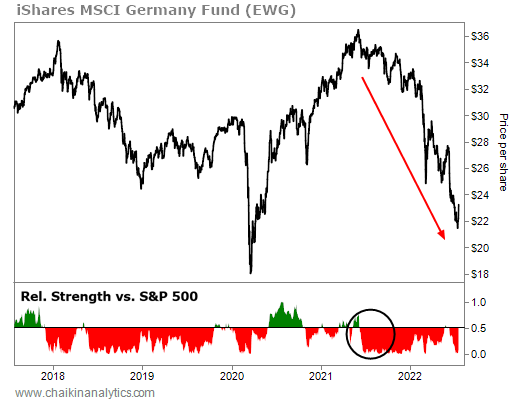

The exchange-traded fund to watch on this developing story is the iShares MSCI Germany Fund (EWG). It tracks a broad basket of German stocks…

Notice that the relative strength breakdown started back in June 2021. EWG is down about 37% from its peak that month. And of course, it can always go lower…

It fell to as low as $18 per share at the height of the COVID-19 pandemic. The natural gas problem could crush business in Germany. So it could fall even further this time.

Imagine it’s the middle of winter in Germany and your electricity goes off…

How long would you stick around?

That’s why we could see a mass exodus to warmer climates. And if that were to occur, it would also lead to a mass exodus in German and other European stocks.

Put simply, Russia is playing a dangerous game. And it holds incredible leverage over Europe right now.

Don’t expect this to be the last gas-delivery hiccup. Keep your eye on German stocks.

Good investing,

Pete Carmasino