On an average day, I use the Power Gauge to look at 100 different stock charts…

It’s important to cover all the bases while hunting for the market’s best opportunities.

And regular Chaikin PowerFeed readers know I’m a big fan of positive “relative strength” changes. That’s when a stock starts beating the S&P 500 Index after a period of underperformance.

But the thing is, relative strength isn’t just for stocks.

We can find opportunities in exchange-traded funds (“ETFs”) this way as well.

As I’ll explain today, one high-tech ETF recently popped up in my search. It experienced a positive relative strength change. And even better, the Power Gauge is “very bullish.”

Let’s dig in…

As my colleague Marc Chaikin touched on yesterday, ETFs are a great way to track market sectors. Specifically, sector-based ETFs allow investors like us to follow the current trends.

But the universe of ETFs stretches far beyond the market’s 11 sectors. Thousands of other ETFs focus on a specific theme – from online shopping to gold to robotics and much more.

In fact, one robotics-related ETF popped up on one of my recent screens. It’s the iShares Robotics and Artificial Intelligence Multisector Fund (IRBO).

Robotics and artificial intelligence cover everything from programmable vacuum cleaners to self-driving cars. These days, you’ll even find driverless tractors on some U.S. farms.

IRBO is a collection of stocks in the semiconductor, software, and cybersecurity industries. Essentially, it’s a technology ETF with a focus on robotics and artificial intelligence.

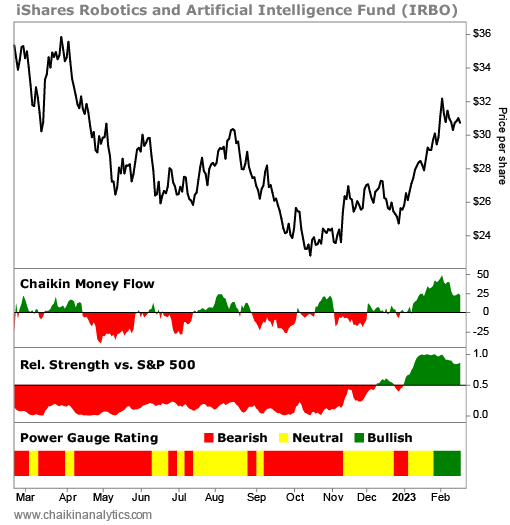

Here’s what the chart for IRBO looks like today…

As you can see in the bottom panels, IRBO underperformed the S&P 500 throughout 2022. And its Power Gauge rating also bounced back and forth between “neutral” and “bearish.”

But at the start of this year, IRBO’s relative strength flipped into the green zone. It’s up around 16% since the beginning of 2023. And the S&P 500 is only up 4% in that span.

In other words, IRBO is experiencing a positive relative strength change.

That makes sense. After all, the tech sector is beginning to gain some momentum.

But the positive relative strength change is just the starting point for our research. From there, we can use the Power Gauge to dive deeper into the potential opportunity…

The Power Gauge rates IRBO as “very bullish” overall today.

Since an ETF is just a collection of stocks, it likely means the holdings within it also look good. And that’s the case with IRBO…

The ETF currently has 22 stocks with “bullish” or better ratings from the Power Gauge. And it only has 12 “bearish” or worse stocks.

Even better, an ETF allows us to diversify our holdings.

With IRBO, we can invest in several robotics and artificial-intelligence stocks instead of trying to pick just the one or two winners in the space. That eliminates single-stock risk.

Our takeaway is simple…

Relative strength isn’t just for stocks. As we’ve seen today, it’s a great tool for ETFs as well.

And in the end, it led us to a potential opportunity in IRBO. Keep your eye on it.

Good investing,

Pete Carmasino