Stop what you’re doing…

Before you do anything else, search “value investing” on the Internet. Then, go to almost any financial website that pops up. I bet they all include a sentence like…

Value investors buy stocks priced below what they’re really worth.

Now, this idea might sound simple. But some supposedly smart people just don’t get it.

The problem boils down to what these so-called “experts” do wrong from the jump…

They mistakenly look for just attractive prices. By that, I mean low valuation ratios. And they completely miss the second half of the sentence (“what they’re really worth”).

You see, many of these experts will tell you that investing is an endless battle of value versus growth. They believe it can only be one or the other. But that’s completely wrong.

I’ll explain what I mean in today’s essay. And as you’ll see, the Power Gauge once again acts as our guiding light. It helps us see that it’s not value or growth – it’s both…

Cathie Wood’s “disruptive innovation” exchange-traded funds (“ETFs”) are prime examples. Her flagship Ark Innovation Fund (ARKK) is down nearly 80% from its February 2021 peak.

We’ve discussed the recent struggles of growth stocks in these pages before…

This recent downtrend is also evident with less flashy, style-based ETFs. For example, the Vanguard Growth Fund (VUG) has fallen about 33% since late 2021.

Meanwhile, despite the rough bear market, value stocks are holding up relatively well. The Vanguard Value Fund (VTV) is only down around 2% over the same span.

However, when we zoom out, the story is much different…

From early 2017 to early 2022, the value-focused ETF rose 57%. Meanwhile, the growth-focused ETF climbed 185%. And ARKK ran way ahead, soaring 354% over that period.

So as investors, we need to figure out which period tells the true story – or if it’s something else. And the harder question is, “How will the value-growth rivalry play out going forward?”

My simple answer is… value stocks have real merit.

Higher interest rates make investors less willing to “discount” profits too far into the future. So it’s easier to disappoint the typically grander expectations of growth-only investors.

But let’s take it further…

Our Power Gauge system includes four valuation ratios among its 20 different factors. And 16 factors relate in some way to a company’s expected future growth and business risk.

I recently explored the interaction between value stocks and the Power Gauge…

More specifically, I studied two sets of strategies over a series of 13-week holding periods. This analysis included 41 test “portfolios” going back a full year to January 7, 2022.

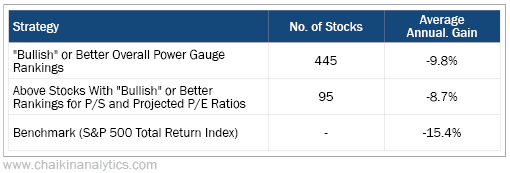

The first group was simply stocks with “bullish” or better overall rankings from the Power Gauge. The second group included the stocks within the first group that also had “bullish” or better rankings for price-to-sales (P/S) and projected price-to-earnings (P/E) ratios.

Here are the average returns (including dividends) of the various portfolios within these two strategies. They’re expressed in annualized terms…

As you can see, combining the Power Gauge with my two favorite valuation factors added almost 1.1 percentage points to an already market-beating performance. And it narrowed the list of qualifying stocks from 445 to 95.

Of course, you’ll also notice that all the returns are negative. And none of us are aiming for negative returns. After all, our goal is to make money – not lose it.

But that’s exactly why my point is so important today…

We can use the Power Gauge to our advantage as value begins to outperform growth.

Growth stocks led the charge for the past decade. But history shows that’s an anomaly. Going back to 1927, value has beaten growth by an average of 4% annually.

And it’s not just statistics. Value meshes with human nature as well…

It’s normal for investors to buy stocks at reasonable prices relative to what they’re really worth. People who ignore that part of the puzzle – like many folks over the past decade – act like car buyers who are paying Lamborghini prices for a Mercedes (or even a Chevy).

If fancy cars are your thing, it’s fine to pay a Mercedes price for a Mercedes. But you never want to pay a Lamborghini price for the same car.

In the end, the Power Gauge is our guiding light. It can help us find the proper balance between the right price to pay for a stock and what the company behind it is really worth.

And when you look at it that way, it’s not value or growth… it’s both.

Good investing,

Marc Gerstein