Not much in life is scarier than the thought of your savings getting wiped out…

Most people these days hold their money in a bank. And for the most part, it’s safe – even if it’s not all physically in the bank’s vault.

That’s because the Federal Deposit Insurance Corporation protects up to $250,000 per depositor.

But as humans, we don’t always think and act clearly when something unexpected occurs…

We often let our emotions get in the way. And we overreact in the heat of the moment.

That’s exactly what happened with the recent banking crisis…

People panicked when Silicon Valley Bank and Signature Bank collapsed. A lot of folks even lined up to get their money out of community and regional banks to avoid losing everything.

The entire banking industry suffered…

Household names like Charles Schwab (SCHW) fell by more than 30% in the aftermath.

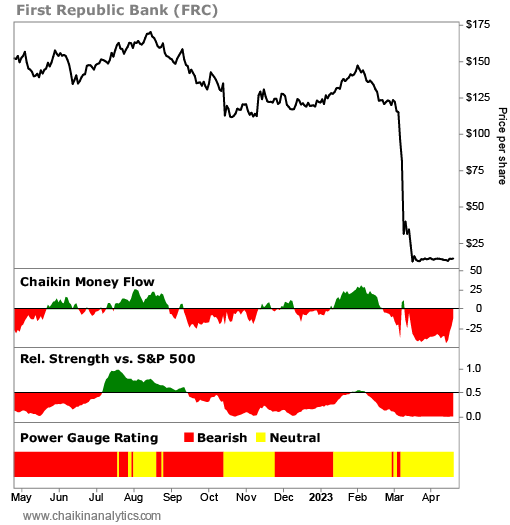

Several small banks almost suffered the same fate as Silicon Valley Bank and Signature Bank. For example, First Republic Bank’s (FRC) stock fell around 90% in about two weeks.

But despite what you’ve likely seen or heard, it’s not the end of banks as we know them.

In fact, many bank stocks are starting to get attractive. So as investors, it’s a good time for us to keep a close eye on the space. And we can do that with the Power Gauge’s help…

The government rushed in during the early days of the banking crisis to guarantee customers’ deposits. And more than a month later, the panic within the space has mostly settled down.

But the prices of many bank stocks are nowhere near their previous peaks…

For example, First Republic is still down about 90% since early February. Take a look…

Now, you’ll notice that the Power Gauge is currently “neutral” on First Republic. That tells us the system is in a wait-and-see mode. So for now, we’ll follow its lead with this stock.

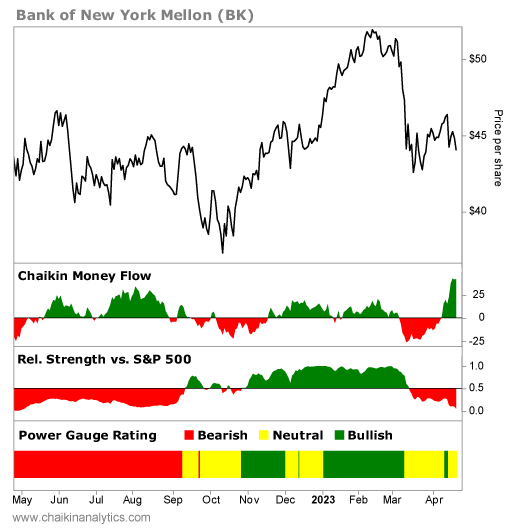

Other regional banks are in a similar situation to First Republic today. But notably, the Power Gauge is slightly more positive. That’s the case with Bank of New York Mellon (BK)…

The system is “neutral+” on this stock.

And I want to point out the Chaikin Money Flow indicator below the main chart. You can see that it recently flipped into the green zone.

That means the “smart money” is buying again.

We love to follow in the footsteps of these powerful investors. And it’s a good indicator that a buying opportunity could be developing.

Folks, the bottom line is simple…

We aren’t ready to sound the “buy” alarm on regional-bank stocks yet. But importantly, the entire industry is showing signs of stabilizing.

Banks aren’t going away – not anytime soon, at least. And a “run on the banks” nowadays just means people are moving their hard-earned savings from one bank to another.

Few folks actually stash stacks of cash in their basement anymore.

That means we can expect the banking industry to stage a comeback at some point. And when that happens, it could lead to huge returns for investors.

The Power Gauge is starting to shift toward better rankings already. And for the most part, the panic from earlier this year has subsided.

Now, we just need to sit and watch patiently. Our one-of-a-kind system is designed to help us know the right moment to buy.

For now, keep these bank stocks on your radar. A strong rally could happen soon.

Good investing,

Briton Hill