The Dow Jones Industrial Average isn’t what it used to be…

When the Dow launched in 1896, it featured 12 industrial companies. The index covered all types of American industry – including electricity, sugar refining, tobacco, lead, and more.

But that’s no longer the case…

Over the past 126 years, the Dow’s heavy emphasis on American industry has changed dramatically. In fact, industrial stocks now only make up about 15% of the index.

That’s critical for investors to know…

You see, industrial stocks are starting to look enticing right now.

However, as I said, the Dow is no longer an industrials-focused index. So we can’t use it to take advantage of this opportunity.

Instead, we’ll use a different investment today. And as you’ll see, it’s already running higher…

In short, we’ll use the Industrial Select Sector SPDR Fund (XLI).

This exchange-traded fund (“ETF”) holds shares of roughly 70 companies. And true to the ETF’s name… all of its holdings are in the industrials sector.

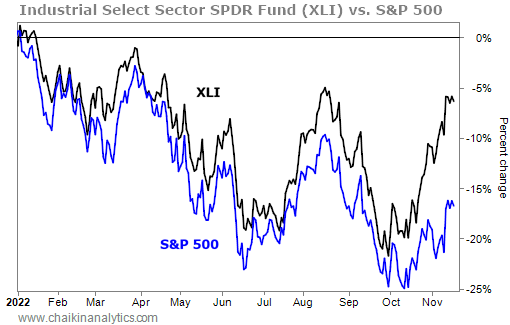

The good news for investors is that XLI has outperformed the S&P 500 Index this year. It’s beating the benchmark index by about 11 percentage points in that span.

However, the bad news is that XLI has been a losing investment overall in 2022. It’s down about 6% this year. You can see what I mean in the chart below…

That likely seems disappointing to you. Why would I highlight a losing investment?

Well, for starters, XLI’s outperformance is now turning into big gains for investors. You can see what I mean on the right side of the chart…

Since the end of September, XLI is up around 20%. The S&P 500 is only up about 11% over that period.

Even better, the “smart money” is likely behind XLI’s recent surge…

Regular readers know the smart money includes Wall Street institutions and other power players. As the nickname implies, they typically know where to find the best opportunities.

That’s why it’s great to fish in the same pond as the smart money.

We can use the Power Gauge to confirm XLI’s smart-money shift…

Specifically, we can use the Chaikin Money Flow indicator. It tracks more than 5,000 stocks at any time.

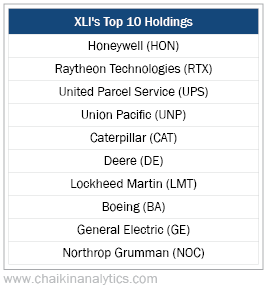

Let’s use it today to look through XLI’s top 10 holdings. These stocks are all likely familiar to you…

The Power Gauge currently rates seven of these 10 stocks as “neutral” or better in the Chaikin Money Flow factor. And it grades two of them – defense contractors Lockheed Martin (LMT) and Northrop Grumman (NOC) – as “very bullish” for this factor.

Specifically, that tells us the smart money is looking at the defense subsector of industrials. It makes sense…

From Ukraine to Taiwan, global tensions remain high today. And with close ties to the U.S. government, these companies help protect our country and allies.

Overall, the Power Gauge rates XLI and Lockheed Martin as “very bullish.” And it’s “neutral+” on Northrop Grumman (which just means the stock is below its long-term trend line).

Put simply… investors are turning to industrials right now.

If you want a broad-based approach to the sector, consider XLI. These days, it’s a much better option than the industrial-in-name-only Dow.

And if you’re looking for individual stocks, Lockheed Martin and Northrop Grumman could be great options as well.

Good investing,

Pete Carmasino

Editor’s note: Chaikin Analytics founder Marc Chaikin recently revealed Pete as his “secret weapon”…

In short, Pete is a tactical specialist in the markets. He has combined his decades of technical trading expertise with the Power Gauge to find stocks with huge potential upside.

Now, for the first time ever, he’s sharing this knowledge with the masses…

Pete joined Marc for a special broadcast earlier this week. Together, they explained exactly how this new investment vehicle could massively boost your wealth if you act now.

For a limited time, you can watch the full replay of this event. And everyone who tunes in will learn a FREE recommendation directly from Marc. Click here for all the details .